- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Deep Pockets

Mold and die machining needs high tech equipment to build complex, expensive tools.

- By Canadian Metalworking

- October 12, 2012

The metalworking industry is simple to understand: we either make parts, or the tools that make parts. Both have challenges, but in each case, offshore competition, slimmer margins and tighter tolerances make it harder to win and keep a good job.

Job shops specializing in mold and die work also have additional stresses driven by the cyclical nature of the industry combined with growth. It’s not necessarily growth in the economist’s sense, but growth in the size and weight of the tools.

Take injection molds, for example. Bigger platens, higher tonnages and faster cycle times mean bigger, more complex molds. And bigger molds mean bigger equipment to machine them, raising the stakes in a game where a job shop can literally bet the company on a major contract. It’s the same story on the tooling side. Major end users like Tier One OEM suppliers are responding to their customers’ demands for fewer parts in larger, more complex assemblies. Simulation software allows modern engineers to design massive tools and dies - and it’s up to the job shops to find a way to build them.

Bigger jobs with tighter margins inevitably put a premium on metal removal rates, and nowhere is this as big an issue as in the injection mold segment. Big cavities were traditionally roughed out with big, aggressive, slow moving tools, but the modern trend is toward lighter cuts, with lightning speed.

Flood cooling simply can’t cut it, so high pressure and increasingly, through-tool coolant flow is a must. Pumping fluid through the tool has a natural limiting effect on the tool choices a shop makes. It’s frequently more cost effective to craft a tooling program with only one or two brands, backed by extensive supplier technical support.

For traditional job shops, it’s effectively a fork in the road. One path is to develop in-house cutting tool expertise, then source inserts and systems based on past experience and engineering expertise available on the shop floor and the front office. The other route is to effectively outsource this task to cutting tool manufacturers and distributors, sending them material and application data and cutting with tools the supplier recommends.

The former lets sophisticated shops “mix and match” to optimize cutting tools for each job, while the latter allow a shop to focus on productivity, although at a higher cost per cutting edge. Which is better? Both can work well, but smaller shops and operations venturing into new materials generally find that manufacturer support trumps a lower up front cost where the edge meets the metal.

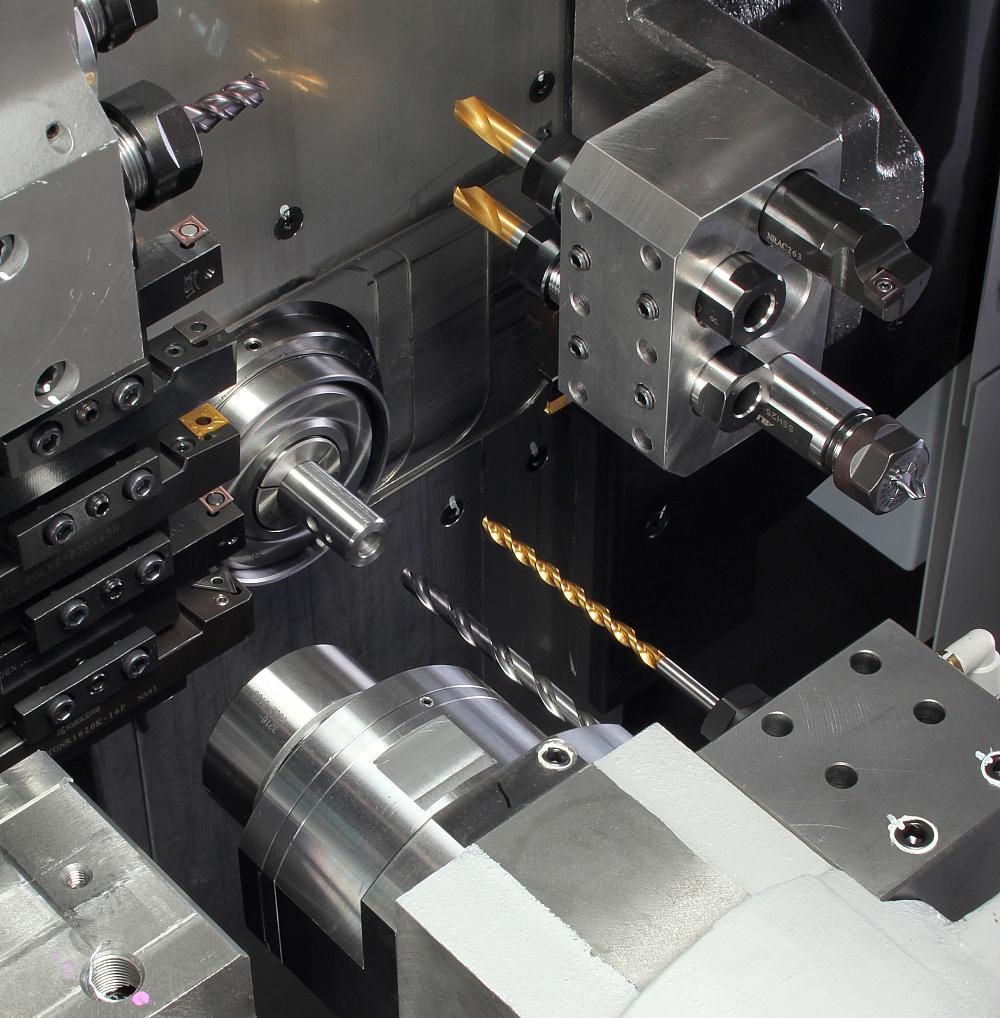

Regardless of the feed or speed, there’s one spindle driving one cutting tool. Are more spindles in the cut the future of machining productivity? According to Steve Bond, National Sales Manager for FANUC RoboDrill, RoboCut & EDM products at Methods Machine Tools, Inc., “Today, there is really no good solution that I know of for machines with multiple spindles for mold work. Although several machine tool builders tried this type of machine configuration in the past, customers found the multiple spindle design did not accommodate higher feed rates and smaller chip loads.

"Technology then moved toward applying more axes, such as 5-axis tables or 5-axis milling heads, to ‘machine all surfaces in one’ fixturing. One set-up provides little or no need to reposition a very large block, so considerable time is saved.”

Mold shops facing large and small cavity work, as well as die shops building big progressives alongside lightweight high-speed “clickers”, face conflicting requirements in their basic milling equipment. Bond states that “’hogging’ material with a high horse power spindle still has its advantages when removing material from large pockets in the mold bases. The smaller and more complicated cavities and inserts are cut on smaller machines with higher RPMs and feed rates and lower horsepower spindles.”

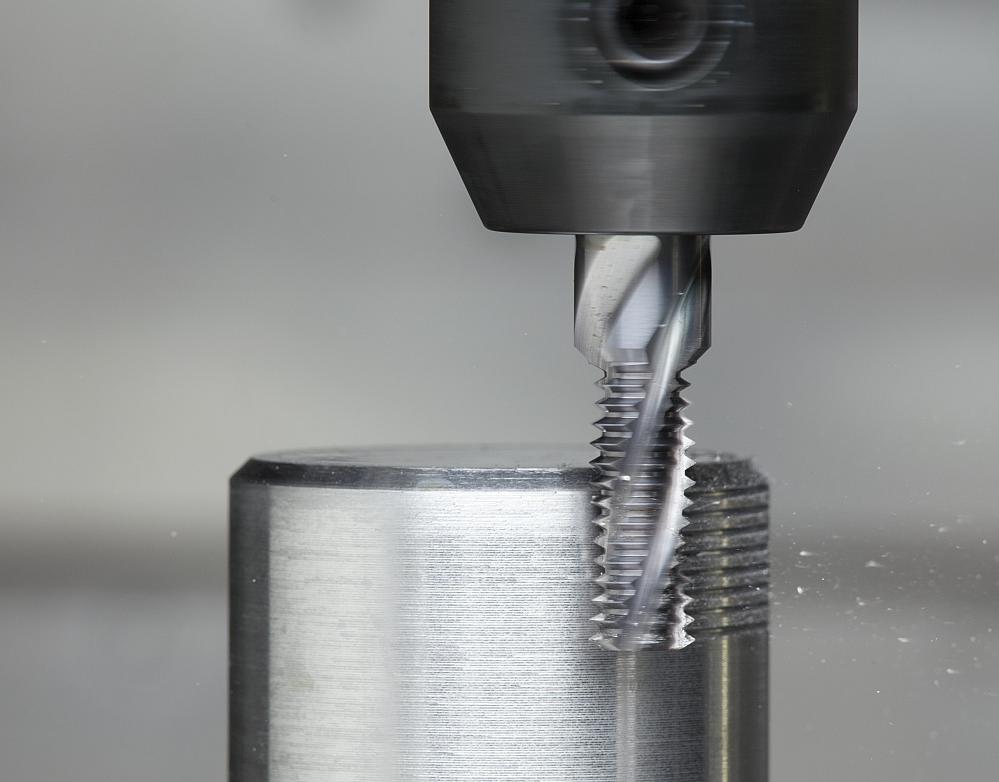

Single or near single set-up machining also means more tasks performed by the centre. Thread milling is an example. Compared with tap threading, thread milling generates superior burr-free surface finishes, and often the same tool can be used for different thread tolerances.

Various materials and hole diameters can also be thread milled with the same tool for reductions in tooling inventory. According to Chris McDonald, product specialist, Sandvik Coromant, “the tool, die and mold industries will take the point on this. They have to cope with dimensioning pre- and post-heat treat. We’re seeing the larger shops in Canada moving toward machining post-heat treat. Any threading will be done with carbide thread mills as opposed to taps. Up to the mid-40’s Rockwell C, tapping is much faster than thread milling. There are some pros and cons to both sides. If you have a catastrophic failure with a thread mill, you typically scrap the part, which may not be the case with a cut tap.”

Reaming is another area receiving attention on the throughput side, declares McDonald. “In large dies and molds, large tools can have five or six-dozen doweled or reamed holes. We have a test product reaming 40 Rockwell C 4340 (a nickel-chromium-molybdenum high-tensile grade-ed) at 57 inches a minute with good concentricity and hole finish. If you have 50, 60 or 70 dowel holes in a shoe, it can make a big difference in productivity.”

Coolant and chip flushing are more difficult in high-speed reaming; expect to see unusual flute spacing, uneven pitch and increased use of exotic helix designs with high-pressure through-tool cooling. McDonald’s task, as a cutting tool expert, is also to cope with more and more advanced metal alloys.

O1, D2 and P20 are still there, but the trend toward specialty grades continues: “Steel suppliers are improving machinability and high hardness”, he states, adding, “we’re seeing application specific grade to take advantage of modern metallurgy. Whether you buy a plain sedan or a luxury car, the major producers are tailoring their chemistries for specific industry attributes. It’s not one-size fits all anymore.”

The route to productivity in this segment is clear: profitable shops need to find efficiencies at every step in the build process. A notable weak spot is still workholding.

While advanced cutting tool vendors can drive toolholding progress, it’s up to the machine user to debottleneck workholding for faster changeover, states Ron Wright, vice president, operations for SCHUNK, “When specifying a machine tool, it’s essential to think about workholding.

"Unfortunately, often the machine tool seller looks at the core machine only and not the accessories. And often the end user doesn’t have the capability to create a workholding solution. We provide those solutions but it’s often at the eleventh hour. It should be considered when the machine is specified. Over the years, machine tool suppliers have been doing less and less of the kind of turnkey service that includes workholding. They typically let the user find their own way in workholding.”

While there are multiple routes to increased productivity, on the shop floor, the emphasis continues on feeds and speeds. Methods’ Steve Bond summarizes: “Tooling manufacturers, along with software companies, have joined forces to advance their technology offering to take advantage of the higher feed rate and RPM capabilities. Spindles capable of speeds in excess of 40,000 rpm to as high as 90,000 rpm are going to change the way dies, molds and components are processed in the coming year and beyond.

"Gone will be much of the 'heavier is better' thinking and more focus will be put on lighter cuts at higher feed rates for finer finishes. Controlling these speeds and the heat associated to the increased RPMs and feed rates are challenging to machine tools builders, but the world’s machine tool builders are spending most of their time, energy and money developing machines that will take tool, die and mold builders to new levels of productivity in the coming years.”

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free SubscriptionAbout the Author

- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI