Vice-President

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Finance Column: Working with Canadian Dollars

When the market is busy, like it is right now, there are always opportunities for growth.

- By Ken Hurwitz

- July 30, 2015

Canadian manufacturers face a number of different struggles inherent to any other business, pressure on margins due to fierce competition, keeping up with the latest technology, holding on to top producers or management, and finding new customers to facilitate growth. In a busy market, like we have now, at some point there is saturation and finding new business opportunities locally or even across Canada can become difficult, so the next logical spot to look for business is beyond our borders.

At the moment, the U.S. market seems to have recovered; they are now busy to a point where their capacity is reaching its limit. The natural move would be to send their excess work up here.

Marv Fiebig, the owner of Ptooling Inc., who had 20 years of industry experience with hands-on manufacturing and engineering experience in industries such as oil and gas equipment, gas compression, aerospace and injection molding, started his own business back in 1999. However, it was during the last four years when he started exporting products into the U.S. where he really experienced a tremendous amount growth.

When I asked him what he felt were the most important factors attributed to his success in the U.S. his response was “working with the government, particularly the Dept. of Foreign Affairs and the EDC, as well as finding and implementing the newest technologies so I could compete effectively.”

The Canadian Trade Commissioner Service (TCS) provides Canadian manufacturers “with on-the-ground intelligence and practical advice on foreign markets to help you make better, more timely and cost-effective decisions in order to achieve your goals abroad…If you are part of the Canadian business community, and contribute to Canada’s economic growth, have a demonstrated capacity for internationalization and have good potential to add value to the Canadian economy, you can benefit from our services.”

Export Development Canada (EDC) essentially assists “Canadian companies sell beyond Canada’s borders, including to the U.S. We do this by providing insurance and financing solutions to companies with export contracts. We also provide guarantees to banks, so they are encouraged to provide their exporting customers with access to more working capital.”

When I asked Marv that question I was surprised he did not include a comment on the prevailing exchange rates, which right now make Canadian products relatively competitive.

Usually when I hear my customers talk about exchange rates it is related to buying equipment and how a weak Canadian dollar makes expensive equipment that much tougher to buy. Whenever I have this conversation, and without question there is some validity to it, it reminds me of a speech Dr. Masahiko Mori, CEO of DMG Mori Seiki Co. gave many years ago when talking about the price of his machine tools and the pressure he gets from his distributors and customers. “If you really want to save money you should negotiate harder with your tooling suppliers, you will spend more money with them than you’ll ever spend with me.”

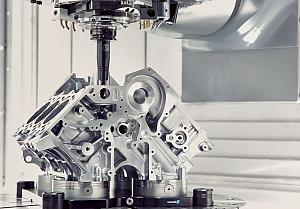

His comments broke up the room. His point however was right on the money, when you buy a quality machine tool it will be installed in your plant for a long time. I walk through shops all the time and see machines we installed back in the 1980s, where the payback was no more than five years and they’re still making money for the owner.

When the Canadian dollar is weaker it makes buying goods from other parts of the world more expensive, and since Canadians are notoriously price conscience, it leads to hesitation. The reality is, if a quality machine is installed it will work and generate revenue for more than a decade, so even if it means paying a premium upfront, the money will still be well spent.

From first-hand experience the best market for machine tools I ever saw, from a seller’s point of view, was the late 1990s. At that time I was working for a machine tool distributor, and we were selling equipment in quantities we had never seen before. At that time the exchange rate was approximately US$1.00 = C$1.48 which was much weaker than it is today, and we could not get our hands on enough machines.

Now, as someone who spends his days financing equipment, I regularly remind customers that leasing the machine is a way to alleviate the difficulty of an unfavourable exchange rate as the impact on the monthly payment is nominal.

They should use their valuable working capital for things like product development, hiring good people, buying material, and of course tooling—none of which can be financed.

When the market is busy, like it is right now, there are always opportunities for growth, not only domestically but globally as well, but in order to take advantage of these opportunities you need to have equipment on your floor to produce product…till next month.

Ken Hurwitz is the Senior Account Manager with Blue Chip Leasing Corp. in Toronto. With years of experience in the machine tool industry, Ken now helps all kinds of manufacturers with their capital needs. Contact Ken at (416) 614-5878 or ken@bluechipleasing.com.

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free SubscriptionAbout the Author

Ken Hurwitz

41 Scarsdale Road Unit 5

Toronto, M3B2R2 Canada

416-499-2449

- Industry Events

ZEISS Quality Innovation Days 2024

- April 15 - 19, 2024

Tube 2024

- April 15 - 19, 2024

- Düsseldorf, Germany

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada