Vice-President

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Know Your Trade Show

Tradeshows offer a unique opportunity to get a deal on new equipment

- By Ken Hurwitz

- September 1, 2016

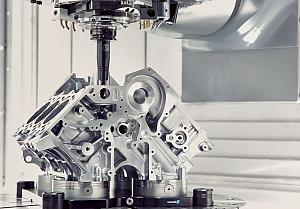

With the International Manufacturing Technology Show (IMTS) just about upon us, it’s time to discuss why visiting this show could be a very productive use of time. IMTS is one of the largest industrial tradeshows in the world, held every two years in September at McCormick Place in Chicago. This year is the 31st edition of the show, which occupies more than 1.3 million net square feet of exhibit space and features 2,000 exhibitors and 114,000 buyers and sellers from more than 112 countries.

It is not only the sheer size that distinguishes IMTS from every other show held in North America, but most, if not all, the exhibits are prepared by the equipment manufacturers as opposed to regional shows, which are for the most part arranged by local representation.

In many cases, the machinery and equipment are manufactured in another part of the world, so for most buyers, visiting the factory may not be time- or cost-effective. This makes visiting IMTS in Chicago worthwhile.

From the perception of a visitor, this means you will find examples of the latest technology, and the people working the booths will be a combination of the smartest and most successful employees from both the manufacturer level as well as its distribution network.

It is contact with these types of people that in itself makes the trip to Chicago worth the time for anyone interested in learning about and potentially purchasing new technology.

To exhibit at a show the size of IMTS takes a lot of time, planning, and, of course money. With such a large investment comes a huge amount of pressure to sell product to justify the expense.

IMTS is also a unique opportunity to meet and engage with the principals of the equipment manufacturers. When you consider the large investment, the show can be a great place to negotiate a deal on a piece of equipment.

I can tell you firsthand that working this show as a seller means spending many hours in a hotel room at night cranking out quotes and finalizing pricing to be ready to continue a discussion with a customer that started on the previous day.

Have a Plan

In today’s world, even a few days away from the shop comes at a significant cost. So, if you are going to make the trip, have a plan in place.

First, there is much more to the show than just the machinery and equipment; you can also visit exhibits for software, measuring equipment, and tooling, with all of these booths staffed with experts. These areas can be just as important to upgrade as your machining centres or multiaxis CNC lathes.

In many cases, manufacturers that invest in new machinery but continue to use their existing programming software will not maximize the efficiency or utilize the new technology to its capacity; therefore, the impact to their bottom line profitability ends up significantly less than anticipated.

However, with all of that being said, if the purpose of the trip is to finalize a decision on a new piece of equipment and take advantage of a “show special,” it is important to ensure that funds are available for the potential purchase.

This could mean just taking the time to work with your chosen financial institution and have a preapproval in place.

To get a preapproval, particularly if you are dealing with a financial institution with which you have an existing relationship, typically all that is required is providing some current financial information for review.

Even if you are simply exploring a new relationship, an efficient institution can review credit applications and financial information in 24 to 48 hours to either provide a preapproval for a specific amount, detail what a potential approval may look like from a pricing and structure standpoint, or simply request some additional information for further analysis.

A standard lease preapproval is normally good for up to 60 days, but in some cases it’s 90 days, so there is no time pressure. In my experience, if the buyer is serious, the deal will close within 30 days. Most important, there is no obligation to proceed. If the buyer likes the terms and conditions, great; if not, the preapproval will just lapse automatically.

Regardless of where the actual capital comes from, the signal sent to the seller by simply telling them you have been preapproved for financing is very strong. The seller will immediately know its potential customer has been checked out and is creditworthy. It also means the seller will know a potential purchase will be paid in full either on delivery (usually with a hold-back until the equipment is running) or installation completion, and it can essentially negotiate a cash price.

Whether the funds come from your own account or a financial institution, the seller knows you are someone who is to be taken seriously and worth spending their valuable time on.

Going to a show with a preapproval in hand may provide an opportunity to negotiate a great deal on a new piece of technology. If that’s the case, it certainly will have been a productive use of time.

Ken Hurwitz is senior account manager, Blue Chip Leasing Corp., 416-614-5878, www.bluechipleasing.com.

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free SubscriptionAbout the Author

Ken Hurwitz

41 Scarsdale Road Unit 5

Toronto, M3B2R2 Canada

416-499-2449

- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI