- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Robotics continues its rapid, upward path

North America has the potential to add more systems than any other continent

- By Sue Roberts

- March 14, 2018

- Article

- Automation and Software

Collaborative capabilities are helping robotic systems fit into a variety of production situations. Photo courtesy of KUKA.

Robotics is a hot industry.

According to the International Federation of Robotics (IFR), global automation is accelerating. Robot density, the measurement used to monitor the technology’s growth while taking into account the different degrees of automation in various countries, now averages 74 robot units per 10,000 employees. Only two years ago that number was 66.

Growth has been significant in North America with overall density in 2016 averaging 122. IFR reported densities of 189 for the U.S. and 145 for Canada. Mexico was still well below the global density average at 33.

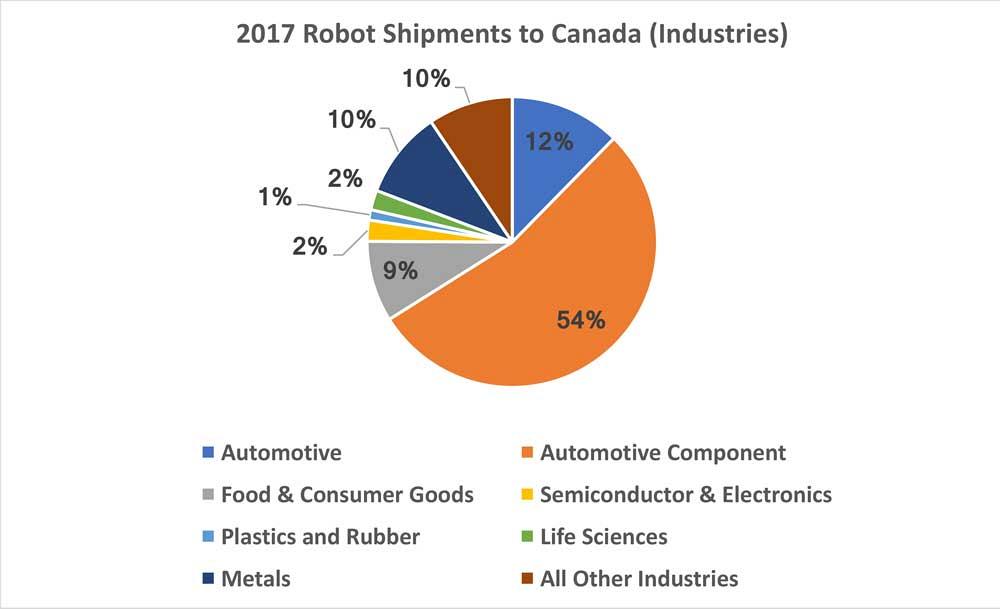

Although the vast majority of systems are still employed by automotive manufacturers, the robotic industry is expected to see growth thanks to a broader acceptance by general industry, including small to medium-sized shops.

For More Than Automotive

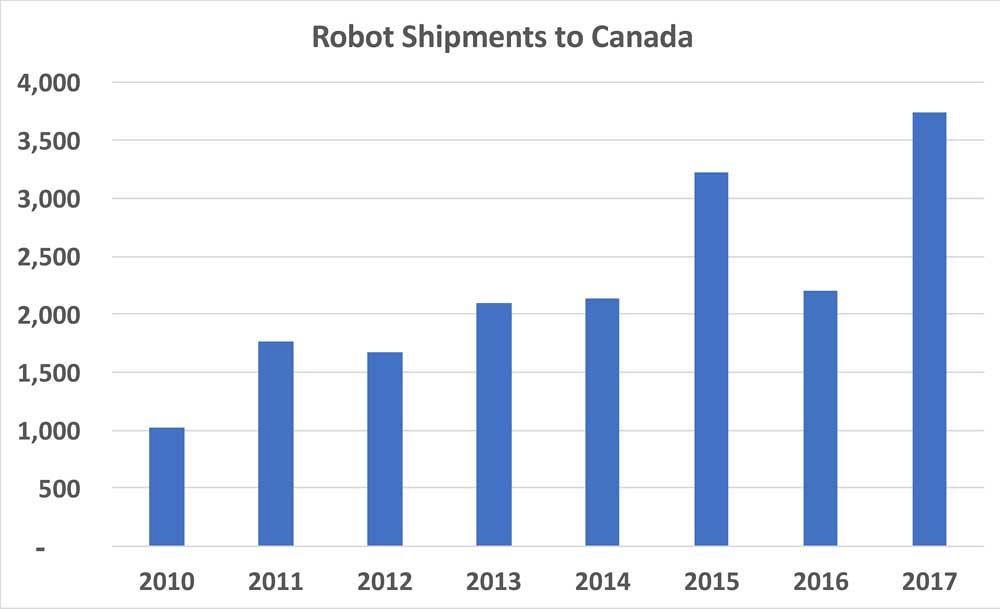

Alexander Shikany, vice president-AIA (Advancing Vision + Imaging), said, “The data we’ve collected anticipates a continuing strong performance of this industry throughout 2018.

“Some would argue that North America might be the strongest continent for robotic activity next year, led by the U.S. with anywhere from a 12 to 17 per cent growth as forecast by the IFR. That’s higher than any European countries, including Germany.

Germany is expected to be lower than past years because its robotics market is reaching the saturation point. Canada is expected to grow just a bit slower than the U.S.

“The automotive industry and tier suppliers have the lion’s share of units and will continue to add. But robotics have become more dexterous and capable, smaller and easier to program, and we are seeing an acceleration in installations in non-automotive industries because of these innovations.

“Some of the main groups are rolled formed steel, raw material processing for steel and other metals, and industrial equipment manufacturers. Fabricating and machine shops are included in growth expectations largely because of collaborative robots that can work alongside operators. That, along with the easier programming, makes their use in a small-batch work environment more of a possibility.”

In the past the costs of installing a robotic system and repurposing it were prohibitive unless a shop produced large quantities of similar parts. But, Shikany said, the diversity and availability of robots that can perform different tasks are making them a viable option.

The use of robotic systems in Canada is expected to continue to increase throughout 2018. Graph courtesy of Robotic Industries Association.

“Sensing technology used in concert with robots, for example, is making systems more sophisticated. Manufacturers are able to make basically any type of robotic system collaborative,” Shikany said. “This is an aspect of their development that is adding to their proliferation outside of automotive.”

Flexibility and Collaboration

Bob Doyle, vice president-RIA (Robotic Industries Association) and A3 (Association for Advancing Automation) Mexico, said that return on investment for robotics is also making them more attractive. “Things like different gripping technologies, payload options, and collaborative possibilities are making it easier for robotics to contribute to the bottom line and ROI is achieved faster.

“Many manufacturers are realizing that if they don’t invest in advanced manufacturing—robotics—their productivity will suffer and they will fall behind,” said Doyle.

“They are also seeing that robotics can help alleviate the worker shortage problem. If they are having difficulties finding qualified people, robots can do some of the more routine tasks, and they can retrain their people to fill the more valuable positions.”

Ashley Szakal, market development at KUKA, said, “Robots complement and augment the human labour by performing routine or dangerous tasks. We see that they do not replace workers, but increase productivity by working with them side by side.

“Unfortunately, negativity about the impact of robots on employment has worked to undermine the positive impact that can be gained by automation; in fact, the more robots that are installed, the higher the employment numbers. According to IFR, the North American automotive industry installed more than 60,000 robots in the past five years and employment in that industry increased. In the U.S. the number of new automotive jobs was 230,000.”

Easier Justification

Peter Fitzgerald, general manager of FANUC Canada, agrees with the assessment of continued growth and market expansion for robotics. “The numbers presented by IFR rang true when put next to our own corporate numbers for 2017, and we expect it to be the same for this year.

“There is a buzz in manufacturing about the industrial internet of things [IIoT], artificial intelligence [AI], and big data. Some people want to adopt robotics to be a part of that buzz. For others, it amounts to taking steps they have needed to take for a very long time to be able to compete,” Fitzgerald said.

“The technology is now at a more comfortable price point, and there is a great deal of focus on ease of use. Some of it can be plug-and-play,” he said.

Szakal said, “Manufacturers are beginning to think more about IIoT and how their processes can adapt and benefit from the new connected manufacturing landscape. Smarter robots that are connected to the cloud are opening new possibilities in big data and machine learning.”

Although the majority of robotic automation serves in the automotive plants and Tier 1 suppliers, other manufacturers are expected to add more systems in 2018. Photo courtesy of FANUC Canada.

Shops that are beginning to invest in robotics may be using them to handle heavy payloads, to eliminate ergonomic challenges, or deal with line rates and speeds where a robot can accomplish the job faster and with more dexterity than other types of automation … or humans.

Job Creation

Most companies working with small batches of products need automation with flexibility and mobility. “They don’t want to make a large capital investment in dedicated automation when they work with smaller quantities,” said Fitzgerald. “When a part or process is going to change, or a contract may end, a robot with the ability to be retooled, redeployed, and reused provides long-term return on the investment.

“There are low-skill jobs that will be impacted by the robotic technology and automation and replaced with positions that require more training, but it has to be done. We are part of a very quickly growing global market, and the productivity gains from robotics are needed to make us competitive,” Fitzgerald said.

“Canada has the advantage of a highly educated workforce with people trained in automation. This can provide for the skills needed to support the growing use of robotics.

“I don’t know that our perspective as a robotics manufacturer is uniquely Canadian—we are here to support the local manufacturers’ needs. What is uniquely Canadian is that we need to help create and support private-sector jobs, especially in manufacturing, because that is where the good jobs are going to be,” said Fitzgerald. “These good jobs are going to be in companies--inside and outside of manufacturing--that embrace automation. It is those companies that will be able to compete globally, and that is what will lead to long-term success.”

A3-Association for Advancing Automation, www.a3automate.org

FANUC Canada, www.fanucamerica.com

International Federation of Robotics, www.ifr.org

KUKA Robotics Canada, www.kuka.ca

Robotic Industries Association, www.robotics.org

About the Author

Sue Roberts

2135 Point Blvd

Elgin, IL 60123

815-227-8241

Sue Roberts, associate editor, contributes to both Canadian Metalworking and Canadian Fabricating & Welding. A metalworking industry veteran, she has contributed to marketing communications efforts and written B2B articles for the metal forming and fabricating, agriculture, food, financial, and regional tourism industries.

Roberts is a Northern Illinois University journalism graduate.

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Trending Articles

BlueForge Alliance partners with Nuts, Bolts & Thingamajigs to develop Submarine Manufacturing Camps

Portable system becomes hot tech in heat treatment

Orbital tube welding webinar to be held April 23

Cidan Machinery Metal Expo 2024 to be held in Georgia May 1-2

Corrosion-inhibiting coating can be peeled off after use

- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI