- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Automotive’s new reality

Tariffs, trade pacts, and big moves by Detroit Three all affect local shops

- By Nate Hendley

- May 6, 2019

- Article

- Management

In 2017 automotive part shipments surpassed $35 billion and industry employment was more than 96,000 people, reports the APMA.

There is a sense of wary optimism among companies that provide parts, services, and equipment to automotive clients, despite some big industry setbacks. Prominent among these setbacks is General Motors’ (GM) decision to shutter its Oshawa, Ont., plant by the end of this year.

While GM’s announcement is bad news for some firms, a recent move by Fiat Chrysler Automobiles (FCA) offers considerably brighter prospects for auto suppliers. In late February FCA announced a US$4.5 billion plan that involves opening a new vehicle assembly plant in Detroit. Should all go as planned, the facility might generate huge contracts for Canadian firms in years to come.

According to Flavio Volpe, president of the Automotive Parts Manufacturers’ Association (APMA), this new build likely will create a demand for $2 billion to $3 billion of parts from southwestern Ontario.

“The closer you are to the plant, the closer you will be in on that $2 billion or $3 billion,” he told Windsor Star.

The effects on local industry

“With the big announcement in Detroit from FCA, we’re jumping up and down [with excitement] in Windsor,” said Tim Galbraith, sales manager at Cavalier Tool & Manufacturing, a prominent mouldmaker based in Windsor, Ont.

Besides these two developments, other top-of-mind topics in the auto supplier sector include technology, the skilled labour shortage, payment terms, and government policy. The sector itself remains a large and important part of Canada’s manufacturing sector.

In 2017 automotive part shipments surpassed $35 billion and industry employment was more than 96,000 people, reports the APMA.

GM’s announcement, made in November 2018, surprised few (the Oshawa facility already had been downsized to 2,500 employees from a peak of 23,000 in the 1980s). The company’s closure plans have provoked a mixed response, to say the least.

“We have such a diversified customer base [that] it’s a very minimal impact for us,” said Adriano Oppio, vice-president of Classic Tool & Die in Oldcastle, Ont.

Classic Tool & Die specializes in metal stamping dies and works primarily with Tier 1 suppliers (although the firm is currently doing an R&D project directly with the Ford Motor Co.). Classic relies on automotive contracts for 90 per cent of its work, so they watch the industry very closely.

“The GM closure will not have any impact on us. Our suppliers work with Honda, Subaru, and Toyota,” said Larry Stuyt, president of Ontario Laser Cutting in Tillsonburg, Ont.

At the other end of the spectrum, Kevin Stubbe, president of Delta Machine & Design based in Ingersoll, Ont., said he is very concerned about the impending shutdown.

Delta offers custom machining services, including assembly assist tooling and repairs for Tier 1 and Tier 2 auto suppliers. Some of the company’s work has involved GM and also the GM-run CAMI Automotive plant in Ingersoll.

GM’s Oshawa announcement has already cost the firm business, said Stubbe.

Other major challenges facing Delta include raw material prices and finding qualified, skilled employees. All are industrywide trends.

Mecon Industries Ltd. of Scarborough, Ont., which makes coil handling equipment for automotive part-makers, shares some of these concerns.

The skilled-labour spectre

Mecon’s biggest challenge is finding skilled labour.

“We went through a really busy period in the fall and winter and we had a hard time hiring people, so we struggled through it,” said Mecon President David Foscarini.

Foscarini’s company offers apprenticeships, typically having one or two working all the time.Cavalier Tool also offers apprenticeships, as well as plant tours for students. The company recently participated in a one-day workshop for students and took part in last year’s Manufacturing Day℠, an occasion designed to highlight career opportunities in the sector.

“We’re doing our damnedest to make sure we have people coming in from the next generation that can do the work,” said Galbraith.

Payment pitfalls

Production Part Approval Process (PPAP) payment terms remain another major source of aggravation among companies serving the auto sector. Under PPAP, each part that goes into an OEM production line needs to meet very high standards. The problem is suppliers don’t get paid until every part is approved—something that can take a very long time.

PPAP payment terms are primarily dictated by the traditional Detroit Three automakers and their Tier 1 suppliers. Some suppliers to the auto sector simply won’t take contracts that demand PPAP-style payment.

“We do not do full payment on PPAP. We typically reject RFQs that demand non-negotiable 100 per cent payment on PPAP terms. The only thing we will do by PPAP is the final payment, which is usually 5 to 10 per cent,” said Oppio.

Apply new technology

If walking away from contracts is one of the only options available when faced with PPAP terms, auto suppliers have been more resourceful when it comes to the skilled labour shortage. While efforts to encourage young people to consider skilled jobs are ongoing, many plants have turned to technology as a way to do more work with fewer workers.

“Most of our lasers run remotely. We run one shift per day manned and two shifts unmanned. We have remote monitors (cameras) and can see the plant off-site either using a phone, tablet, or computer system,” said Stuyt.

At Mecon, the company’s larger CNCs all are hooked up to the computer network so programs can be downloaded quicker.

“We’re not at the stage where we’re actually monitoring machine function, but that’s probably not far in the future,” said Foscarini.

At Classic, meanwhile, the machinery has been networked together for decades and the company is now transitioning into computer work station virtualization.

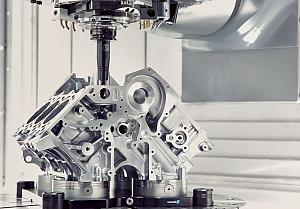

Virtualization combines the computing power of several CAD workstations into a non-physical (virtual) computing resource called a host machine to maximize efficiency. In addition to virtualization technology, Classic has fully automated CNC machines, a 3D printer, and a 3D laser scanner. While Classic finds its MakerBot 3D printer useful, Oppio doesn’t think 3D printing technology will become widely adopted in automotive circles until it can keep up with the speed demanded by mass part production.

“Automotive is all about high volumes. I can’t see it being a viable solution for the automotive market, on a production level, other than prototype builds or [producing] fixtures,” said Oppio.

On the other hand, Oppio describes his 3D laser scanner as a huge asset. The device identifies, analyzes, collects data, and creates 3D models to be used in design, manufacturing, and quality. New technology has allowed Classic to boost productivity and decrease downtime, he added.

Cavalier uses embedded radio frequency identification (RFID) chips to gather and transmit data, is looking at an automated storage and retrieval (AS/R) system for storing and retrieving components, and has embraced digital twin technology.

A digital twin is a virtual model of a process that enables manufacturers to solve problems before they even occur.

“We now do manufacturing simulations. We take our tool design in 3D and simulate the moulding sequence in the press. We can digitally simulate that for our customer and for quality checks as well,” explained Galbraith.

The politics of manufacturing

Outside of the high-tech realm, shop owners are keeping a close eye on several political developments, including tariffs, trade pacts, and funding programs.

Last year the U.S. government imposed a 25 per cent tariff on Canadian steel and 10 per cent tariff on Canadian aluminum. The federal Liberals in turn slapped retaliatory levies on American steel, aluminum, and other products. In late 2018 Ottawa announced a program whereby some Canadian companies negatively impacted by tariffs can apply for financial relief, which now has become reality.

“[Tariffs are] a major thorn in our side. We’re trying to figure out this whole tariff system. Even our broker who we’ve been using for a number of years doesn’t really have the straight answers for us on how to move forward. We are losing business based on the tariffs,” said Oppio.

“We purchase specialty metals [that] need to be processed in the U.S. so the tariffs apply to us. We have stopped those purchases because it adds too much cost to the end product,” added Stuyt.

According to Stubbe, tariffs have driven up the cost of some of Delta’s purchases by up to 200 per cent.

The debate continues about how the new U.S.-Mexico-Canada Agreement, which is supposed to replace NAFTA, will impact business. While it has yet to be ratified, some fret it will gut the Canadian automotive sector.

Not so, said Galbraith, who described the new trade pact as a win.

“I think the regional vehicle content in some of the clauses in there will assist our industry in keeping business here in Windsor, and in Canada. We believe the USMCA is a win for our industry.”

Other important government initiatives include the Automotive Supplier Competitiveness Improvement Program (ASCIP), which is administered through Ontario Centres of Excellence and the APMA. ASCIP provides up to $100,000 in funding to small and medium-sized automotive manufacturers for projects involving the adoption of technology and productivity enhancements.

Oppio spoke highly of the ASCIP, which Classic has applied to for project funding. He is disappointed how certain political developments have put some funding programs in jeopardy.

Funding initiatives for automotive manufacturers have been getting phased out or changed drastically.

The elimination of funding programs for consumers also has proven problematic for shop owners. In July 2018 the Ontario government cancelled the Electric and Hydrogen Vehicle Incentive Program, which offered rebates up to $14,000 (depending on the vehicle) for Ontarians who bought an electric car.

“Some of the components we supply are for those types of vehicles. Because Ontario’s new PC [Progressive Conservative] party has trashed the purchase discounts, people can’t justify purchasing an electric car,” said Stuyt, who worries that culling the incentive program will cut into his bottom line.

Despite all these developments, Mecon’s Foscarini said he is still reasonably optimistic for at least this year because his level of quoting has been good.

“The automotive sector is going to be very interesting over the next few years. I think we are going to see lots of change,” added Stuyt.

Contributing writer Nate Hendley can be reached at nhendley@sympatico.ca.

Cavalier Tool & Manufacturing, www.cavaliertool.com

Classic Tool & Die, www.classic-tool.com

Delta Machine & Design, www.deltamachinecanada.com

Mecon Industries, www.mecon.com

Ontario Laser Cutting, www.ontariolasercutting.com

About the Author

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Industry Events

ZEISS Quality Innovation Days 2024

- April 15 - 19, 2024

Tube 2024

- April 15 - 19, 2024

- Düsseldorf, Germany

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada