- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Big changes, big profits

Canada’s die/mould sector is changing thanks to new technology, political developments

- By Nate Hendley

- November 3, 2017

- Article

- Management

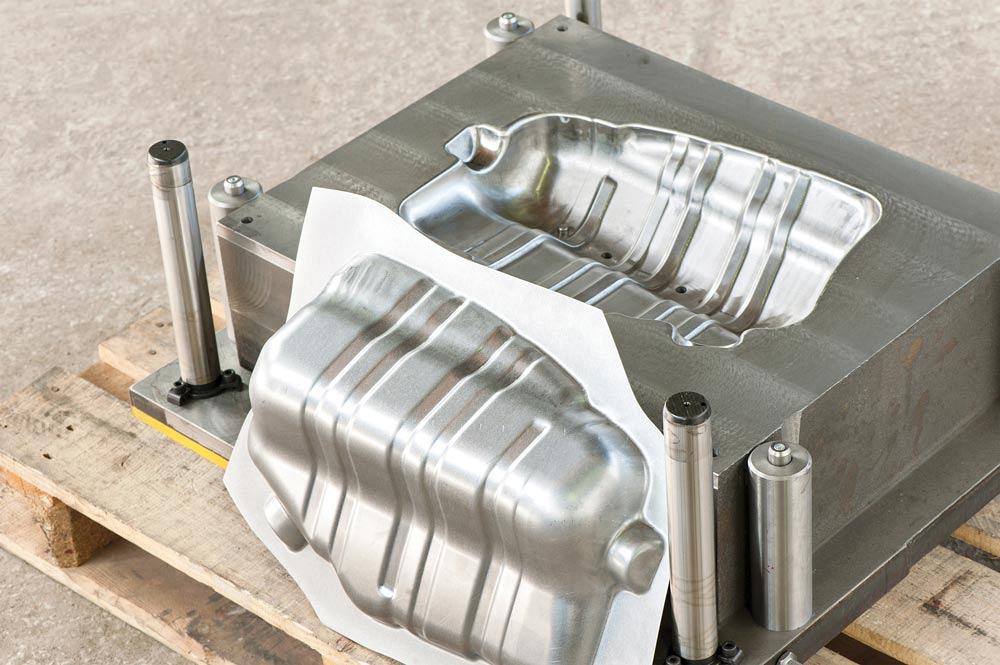

New developments in mouldmaking could mean big opportunities for shops that can adapt as the sector transforms.

Things are good right now for Canada’s die/mould industry.

But some technological, industrial, economic, and political developments might have a major impact on die- and mouldmakers in the near future. Some of these developments represent new twists on old trends, but all of these changes could mean big opportunities for shops that can adapt as the sector transforms.

“Several industries—automotive, aerospace, appliances—that these guys are making tools for are doing quite well,” said Laurie Harbour, president/CEO of manufacturing consultancy Harbour Results Inc., Southfield, Mich. “The industries are strong, revenues are high. There are lots of new products being launched. As a result, tool suppliers have done very well in 2017. For the most part, the industry is busy in Canada and the U.S. We predict that it will probably stay relatively [busy] through the next 18 to 24 months, largely propped up by automotive.”

A total of 2,370,271 vehicles were made in Canada in 2016, a 3.8 percent increase from the year before. Some 12.2 million vehicles were made in the U.S. and 3.6 million made in Mexico in 2016 (a 0.8 per cent and 0.9 per cent increase, respectively, from the previous year), reported the Paris-based International Organization of Motor Vehicle Manufacturers.

Automotive sales are up too. Between January and August 2017, some 1.4 million light vehicles were sold in Canada, a 5.3 per cent uptick from the same period the previous year, according to DesRosiers Automotive Consultants Inc., Richmond Hill, Ont.

New Paradigm: Sharing Parts

For die/mould shops doing automotive work, sharing parts is becoming the new reality.

“What the OEMs are trying more and more to do is utilize some parts on multiple vehicles. When they start sharing parts on different vehicles, the tooling packages aren’t as large,” explained David Palmer, sales manager at Build-A-Mold, a division of Plasman Group, Windsor, Ont.

Jonathon Azzopardi, president and CEO of Laval Tool and Mould, Tecumseh, Ont., agreed but says this isn’t a new trend.

Asian carmakers such as Honda and Toyota have been producing vehicles with shared parts for a long time.

“The domestics are just embracing it a little more. We’re hearing about it a little more,” said Azzopardi, who is also chair of the Canadian Association of Mold Makers (CAMM) and vice chair of the Automotive Parts Manufacturers’ Association (APMA).

OEMs are also spearheading a trend best described as bigger is better.

“The automotive OEMs and aerospace guys want to focus on having a handful of big suppliers that can handle big packages at a target price. And I’ll let them farm work out to China or the little guys. Some of the big mould builders in Windsor are just getting bigger. They’re feeding a lot of smaller shops. If the market softens, if I’m a big shop, I pull that work back in-house. I don’t outsource anymore, and now the little guy struggles,” said Harbour.

“We’re seeing a trend right now, and I think the die shops are seeing it too; there’s a push for medium-sized shops to grow larger, to become large shops. This means there’s now this gap that small shops should grow into medium shops, and we’re not seeing that. We find that the small shops are being left out or can’t find a place in this new dynamic, so there may be a time for mergers and acquisitions on the horizon,” said Azzopardi.

Offshoring is a trend that isn’t new but is changing.

To cope with offshoring, many Canadian companies have established partnerships with Chinese firms to offer a lower cost option to clients. Build-A-Mold, for example, works with three shops in China. A program manager from Build-A-Mold’s Canadian operations supervises production.

Laval has an arrangement whereby Chinese partners make non-critical components for the company, according to Azzopardi.

“There’s a lot of Canadians, a lot of U.S.-based shops in partnership with China. If they get a package of 30 tools, they’ll send 10 to China and build 20 in-house so they can leverage the cost structure and the time. There are some shops in Canada that have had relationships with China for 25 years. What is [new is that] some of the shops that have resisted it for years are coming around, saying they can’t resist it anymore,” said Harbour.

Reducing Offshore Reliance

Some experts predict offshore competition is going to diminish over the next few years.

“We believe the low-cost countries will continue to have an impact on tooling in North America, but we think it will become less and less, because as we add more technology, we become more efficient. The difference [in cost] between overseas, low-cost sources and ourselves is about 30 per cent. We believe there’s all kinds of other services and guarantees we offer that they can’t, so we can make that 30 per cent almost go away, based on the value-add we can bring to the table,” said Azzopardi.

Rising production costs in low-cost countries also might help even out this price difference.

“If our shops can be quick, efficient, and cost-effective, that’s how they will deal with offshore competition,” said Mike Hicks, vice president at DMS Components, Oldcastle, Ont., and second chair of CAMM.

The Mexico Effect

Another trend has been for Canadian die/mould shops to set up satellite operations in Mexico. Again, this is not a new development, but it’s an option that might become increasingly important for shops looking to expand.

Aalbers Tool & Mold, Oldcastle, Ont., has a Mexican branch, staffed by three Canadians and six local employees. Laval has a small joint venture in Mexico that handles maintenance and repair duties.

Azzopardi said that working with the Mexican joint venture can be difficult, but shops have to look beyond Canada’s borders if they want to grow.

Setting up a branch in Mexico “is a step that mould companies should consider. If there’s not an export or an expansion of their footprint outside of Canada and the United States in their business model or business plan in the future, I think mould companies will be making a mistake, because the domestic market is limited. If you’re looking to grow, you have to grow outside of the [domestic] market,” he said.

Role of Technology

It’s also important for die/mould shops to consider the role of technology in the development of their industry. This includes technology that might seem fringy at the moment, such as 3-D printing, electric cars, and autonomous vehicles.

While 3-D printing is definitely growing, it remains very expensive, said Harbour.

“For the most part, it’s sort of an enhancement for our industry; it’s not a threat at this point. To the best of my knowledge, they’re not building production tools with 3-D printing. Our jobs are definitely not in retreat from it,” said Hicks.

In a similar vein, Harbour doesn’t think electric or autonomous vehicles will have a major impact on the die/mould sector for a decade. She makes clear, however, that shops would be foolish not to pay attention to such developments.

“The biggest thing about all these technologies is that we’re going to see more change in the next five years than we did in the last 20. I think we’re going to see a lot more R&D in the automotive industry focused on electronics and autonomous vehicles. I think the vehicle itself is going to change dramatically. [These changes are] going to be driven by electronic technology. I think we’re going to see the emergence of big data happen at a much greater scale,” said Harbour.

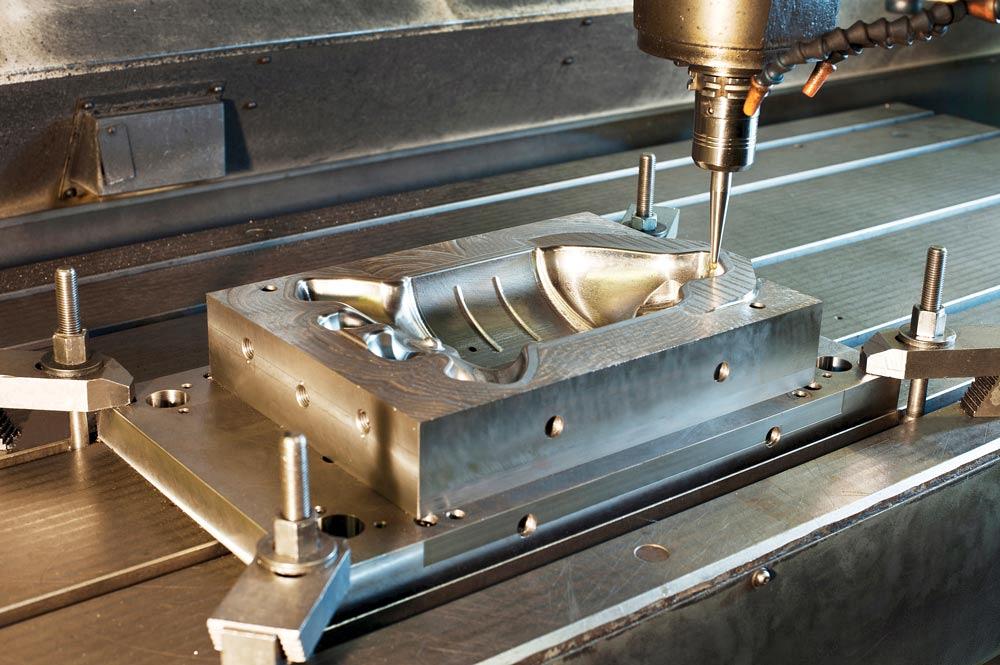

Data-gathering is central to Industry 4.0—a tech trend that has been widely embraced. Industry 4.0 describes a move toward automation, cloud computing, and the Industrial Internet of Things (IIoT) in manufacturing environments. The aim is to create a high-tech smart factory.

“We continually look at opportunities to bring more Industry 4.0 onto the shop floor. Right now we don’t use any paper printouts. We’re totally paperless on the shop floor,” said Azzopardi.

Laval also has set up an IIoT system to monitor performance data on three of its CNC machines.

Automating processes, meanwhile, will pay major dividends for anyone worried about competition from offshore or elsewhere.

“If shops don’t start to adopt these technologies, the Chinese will, and then you’ll be even further behind. They’ll have low cost and technology. [You have to be] taking advantage of these opportunities to make you efficient,” said Azzopardi.

Lightweighting Trend Emerges

Another existing trend that’s becoming mainstream is lightweighting (making parts out of lighter materials, such as plastics and composites). In automotive circles, lightweighting is being driven by U.S. government regulations mandating better fuel efficiency over the next few years. Aerospace, defense, and other sectors are also getting into lightweighting primarily to save on fuel costs.

“Lightweighting has had a huge impact on the mouldmaking industry because it’s created all kinds of new opportunities out of old processes. We take advantage of this all the time. About 70 per cent of our business has something to do with lightweighting,” said Azzopardi.

In addition to building moulds, Laval does design and engineering work, which means the company can offer a range of services to clients interested in lightweighting. Among other customers, Laval has worked with electric car pioneer Tesla on lightweighting concepts.

Looming over everything is the possibility of changes to the North American Free Trade Agreement (NAFTA). U.S. President Donald Trump has made noises about pulling out of NAFTA, or at least modifying the treaty in the U.S.’s favour.

“We are all waiting to hear what the NAFTA changes might be. This could change how we do business in the future,” said Toni Hansen, president of Aalbers Tool & Mold.

Companies are taking a “wait and see [approach to NAFTA]. I don’t think we’re worried, but we’re certainly cognizant of it. We’re seeing how things develop and certainly voicing any concerns prior to any agreement being made or finalized,” said Build-A-Mold’s Palmer.

For all that, die/mould industry experts remain highly optimistic for now.

“I’m excited about the industry. We’re still healthy. All indications are we’re still going to be healthy through 2020. We might see a little bit of a step back, but certainly nothing to any extremes like we had back in 2008-2009. It’s a good industry to be in right now, and hopefully we can ride it out for another three years,” said Palmer.

Contributing writer Nate Hendley can be reached at nhendley@sympatico.ca.

Aalbers Tool & Mold, 519-737-1369, www.aalberstool.com

Build-A-Mold, 519-737-6984, www.buildamold.com

DMS Components, 519-737-6743, www.dmscomponents.com

Harbour Results, 248-552-8400, www.harbourresults.com

Laval Tool and Mould, 519-737-1323, www.lavaltool.net

About the Author

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI