Associate Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Driven to succeed

Marwood stamps and produces components for many of today’s vehicles

- By Lindsay Luminoso

- April 20, 2021

- Article

- Fabricating

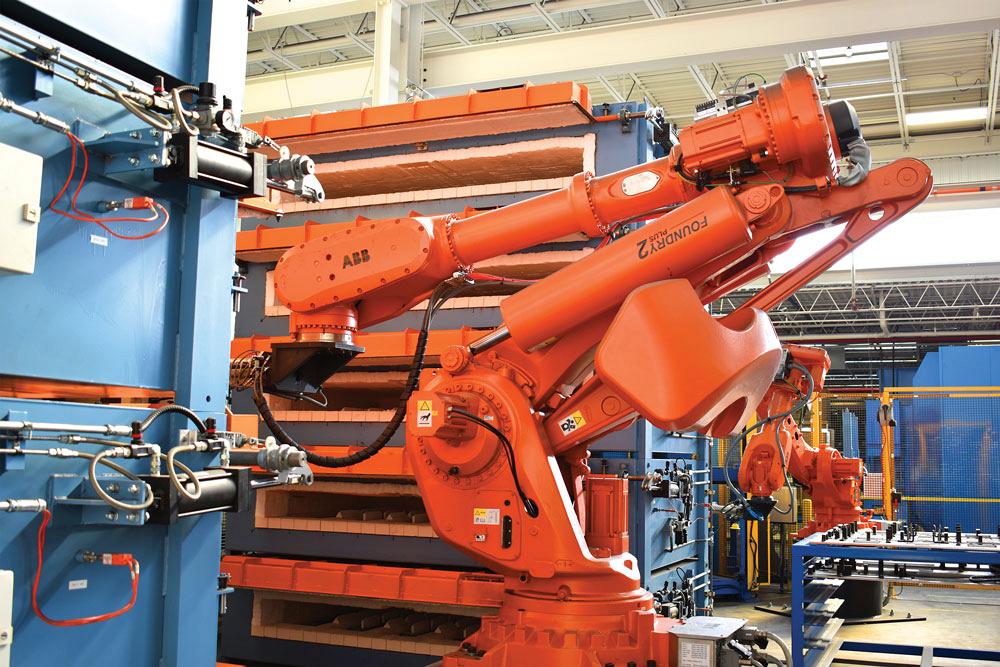

One of the things that sets Marwood apart from other manufacturers is that its facilities support numerous automotive OEMs. Inside the different OEM sections, the company also works on multiple programs. Images: Marwood International

Driving down the 401 highway and exiting off towards Tillsonburg, you may think that you are headed in the wrong direction, away from most of the automotive manufacturing in Ontario. But in the nearby small community of Brownsville, Ont., is Marwood International, founded in 1990 when Chris Wood, Henry Spanjers, and Erwin Hawel opened a 10,000-sq.-ft. facility with two presses and nine employees.

In the beginning, Marwood was a dedicated small and medium-size parts manufacturer for CAMI Automotive of Ingersoll, Ont. CAMI was so impressed with the job Marwood had done on some initial work inherited from a division of Magna, it asked if the business was interested in participating in the bidding process for future programs, which eventually propelled Marwood to become a leading automotive manufacturing facility.

The shop expanded into some Tier 2 work within the CAMI-Suzuki relationship, and that eventually led to initial networking and business with Subaru, which at the time was still very new to manufacturing vehicles in North America. When the automaker expanded into North America, Marwood was one of the first companies to reach out and has been a key supply partner ever since.

From those humble beginnings, the company has grown over the years to include six manufacturing facilities—four in Tillsonburg, one in Woodstock, Ont., and one in Detroit—with more than 500 employees across its locations. The ownership structure has remained the same, with Wood, Spanjers, and Hawel continuing to lead the way.

"I think that’s what makes us unique," said Tyler Wood, vice-president of business development, Marwood International. "We’re a relatively small fish playing in a very big pond, but we’re trying to grow in this space while still maintaining our family and community values, which is a core principle of Marwood. We have a lot of pride in the fact that our owners live and work in this area, and we are focused on building up and helping the community through various initiatives. We are also supporting jobs across the region. We’ve invested big in technology, and when customers come to visit our facilities, we often hear how blown away they are by the technology that we have in our shops."

Marwood also has focused on developing automation internally. While it has purchased robots and some of the latest capital equipment, it also has spent many years building and developing a manufacturing engineering and automation controls team instead of outsourcing. The CEO’s message is that if the shop can build equipment internally, the staff will know how to maintain it and fix it when needed, which will lead to better, more robust processes and an overall better-quality product.

Automotive Sector

Marwood’s focus has always been on Class B and C stampings and modular assemblies. However, over the years, the company has invested in lightweighting and press-hardened steel (PHS) technology.

"There is lots of competition in this space, but the bigger guys tend to invest in very large and expensive lines, and they need very high volumes to support their capital investments," said Wood. "But all OEM customers still need lightweight, strong products in their lower to mid-volume product lines, and that’s where we come in. What we’ve built at Marwood is more flexible so that we can do changeovers quicker. We have developed some patents for our press technology and the process of making certain products. It provides a value to the customer, and it’s a bit of a niche area. This does not mean that Marwood is not capable of supporting higher-volume PHS products like it does to support the common product on the Jeep Wrangler and Gladiator product lines. What sets its PHS technology apart from the rest is that ability to support low-, mid-, and high-volume products at fair market prices."

The shop’s facilities are broken down into divisions based on commodity. Its Plants 2 and 3 focus on stamping, and Plants 1 and 4 focus on PHS, laser trimming, and modular assembly. Most of the company’s employees are split across these two commodity groups. The Woodstock facility (Plant 5) is focused on e-coating and light assembly, and the Detroit facility (Plant 6) operates a variety of mills, presses, and assembly, as well as supporting tool and die build and repair.

One of the things that sets Marwood apart from other manufacturers is that its facilities support numerous automotive OEMs. Inside the different OEM sections, the company also works on multiple programs. For example, Marwood’s GM section includes upwards of 30 different programs, with some programs having only a few parts and others having more than 50. There is quite a bit of variation.

The shop’s main customer base is split evenly among General Motors, FCA, Subaru, and Toyota. The volumes depend on the product mix, but for the most part, each section remains fairly diverse, with lots of different parts in different programs.

The shop’s main customer base is split evenly among General Motors, FCA, Subaru, and Toyota. The volumes depend on the product mix, but for the most part, each section remains fairly diverse, with lots of different parts in different programs. The company is focused on diversifying and ensuring that it doesn’t rely on any one section primarily.

Electric Vehicles

One area for growth for the company is in electric vehicles (EVs). The business is currently tracking how many of its components are being used in EV platforms.

"We have really stayed engaged with lightweighting, which is key to any OEM EV project. We’ve worked really hard and invested a lot on research and development on lightweighting product initiatives such as parts produced from aluminum and PHS. And we have also recently invested and been awarded our first glass fibre composite products," said Wood. "For the most part, our components usually support the body structure, battery trays, and underbody skid shields. But we are also tracking which of our parts go on internal combustion engine vehicles versus those going into EVs. We’re starting to be able to trend that, and we can show our customers that we are able to grow with this trend."

Wood added that the company is cautiously expanding into the EV market in a controlled manner. He recognizes that not all EV platforms are going to take off, so it is important for the shop to ensure that it is making products that go into vehicles with long-term success.

"It’s going to be something that we’re going to have to obviously watch," said Wood. "The majority of our products through 2030 are still going to be on conventional ICE powertrain product lines with maybe 10 to 15 per cent of the mix introduced into EVs. But as we start to look at programs that extend into the 2030 and 2040 production life cycle, we have to be a bit more aggressive, because that’s really where we are going to see EVs taking off and becoming mainstream."

Stamping Capabilities

One of Marwood’s biggest commodities is stamping, and the company has spent a great deal of time and money on making sure it can provide customers with quality products quickly.

"Over the last five years we have transformed our stamping division away from mechanical presses to servo-driven presses," said Wood. "We did this for a couple of different reasons. Servo presses are quicker and more productive. With a servo press, we can program it by job. For example, depending on the job, we can make sure that when the ram comes down, we can actually slow the process so we don’t split the material when forming. In a mechanical-style press, it becomes much more difficult to do that."

Wood added that another advantage of the servo press comes from a safety perspective. This type of press will stop much faster than a mechanical press if, for whatever reason, there’s a break in the light curtain.

Challenges

"There are lots of challenges in our industry," said Wood. "Sometimes we’re all just crazy for doing what we’re doing every day. Over the last five years in particular, the challenges seem to be so much more outside our control than they used to be. For example, the tariffs on steel and aluminum were very difficult for us to manage. Or obviously COVID, which is not just impacting us but nearly all industries. We’ve been rather fortunate that we were able to keep working in a safe manner and that the customers are still pulling decent volumes."

Wood also noted that there is some instability in the market, specifically semiconductor shortages and steel tariff issues.

Marwood is capable of supporting high-volume PHS products like it does with common products on the Jeep Wrangler and Gladiator product lines. What sets its PHS technology apart is the ability to support low-, mid-, and high-volume products at fair market prices.

These issues are difficult for any shop to deal with because external factors play such a huge role in day-today operations.

"If a major facility goes down for a week, that could seriously impact us," said Wood. "Some facilities are obviously more impactful to us than others. For example, CAMI is experiencing a bit of downtime as GM is moving semiconductors to its higher-demand truck and SUV platforms. As recently as four years ago, CAMI was about 50 per cent of our business, and at that time, it would have been really hard for us to run the business if that facility was down for three or four weeks."

Lucky for Marwood, the shop currently doesn’t have any significant business on platforms that are experiencing impactful levels of downtime right now, but that could change at any point and have an effect on how the company moves forward.

Future Successes

"One of the big opportunities for us comes in implementing Industry 4.0 into our processes so we can monitor at the management level, we have our screens, and we can trust the data," said Wood. "We are trying to switch to a model where we’re being proactive about our equipment and processes and ensure that we can perform maintenance checks as needed."

For Marwood it’s all about dealing with facts. Having collected data and information allows the shop to set ambitious targets and manage expectations and growth.

"Our plan is to continue to grow," said Wood. "Right now our book business is about C$120 million in annual sales, and in the 2023-24 timeframe we think it’ll be about C$150 to $160 million depending on how volumes turn out. I think one thing we’ve done very well over the last decade is really improved upon our model for long-term success. We’ve moved away from that feast-and-famine type model where, when the business is in trouble, maybe two years from now, a shop takes on additional risk and puts itself in a position to fail. We’ve done a really good job improving our upfront model for evaluating business and being more aggressive on the right work for us."

Marwood is trying to get to the C$175 to $200 million per year mark with its current footprint, especially if it can generate a bit more out of its Detroit facility and a few more value-added parts in its Canadian locations. But for right now it’s focused on being a full-service provider to its automotive customers.

"One of the most common pieces of feedback from customers is that we have that big company feel because of our technology, but we still have that small company feel as it pertains to the day-today interaction," said Wood. "When you deal with some large OEM customers like Marwood does, they can all be very demanding. But we make sure that we can support those demands."

Associate Editor Lindsay Luminoso can be reached at lluminoso@canadianfabweld.com.

Marwood International, www.marwoodinternational.com

About the Author

Lindsay Luminoso

1154 Warden Avenue

Toronto, M1R 0A1 Canada

Lindsay Luminoso, associate editor, contributes to both Canadian Metalworking and Canadian Fabricating & Welding. She worked as an associate editor/web editor, at Canadian Metalworking from 2014-2016 and was most recently an associate editor at Design Engineering.

Luminoso has a bachelor of arts from Carleton University, a bachelor of education from Ottawa University, and a graduate certificate in book, magazine, and digital publishing from Centennial College.

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Trending Articles

Orbital tube welding webinar to be held April 23

Portable system becomes hot tech in heat treatment

Cidan Machinery Metal Expo 2024 to be held in Georgia May 1-2

CWB Group launches full-cycle assessment and training program

Achieving success with mechanized plasma cutting

- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI