- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Incomplete Payback Data Can Undermine Energy Upgrades

Determining the real return on energy efficiency means calculating all savings

- By Paul Rak

- December 11, 2013

- Article

- Management

There is a serious flaw in how many businesses decide whether or not to approve energy upgrades in their facilities.

Most capital expenditure decisions are based on payback periods calculated by dividing the annual energy savings achieved with the new equipment into the initial project cost. Even standard government and accounting forms used for energy upgrade incentives ask only how much energy will be saved and what the project cost will be.

Certainly, the amount of the energy savings is key to making a good decision, but most calculations stop at this point. The large part of the formula that is missing is the financial value of the maintenance cost savings and the costs that the company will avoid with the newer, more efficient equipment.

These costs are real and show up on the company’s income statements, but rarely ever factor into the executive decision on whether or not to proceed. This is especially important when we see that these costs and savings are often greater than the energy savings.

Without this data in the payback calculation, companies will never realize the true savings of performing the energy upgrade because they will not be able to approve the project based solely on energy savings.

Following are actual examples from several recent business cases that showcase this exact point.

Case 1: Compressor Upgrade Cuts Maintenance Costs

A Cambridge, Ont., manufacturer considered replacing a 20-HP compressor with a more energy-efficient, 10-HP compressor after an energy audit showed the 20-HP compressor was very much underutilized.

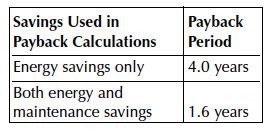

Annual energy savings were calculated to be about $2,660, which resulted in a payback for the project of just over four years. Company management decided not to proceed with the upgrade. However, the maintenance staff persevered and collected equipment repair data (see Figure 1).

Maintenance personnel found that the average annual maintenance and repair costs of the 20-HP compressor between 2005 and 2010 were nearly $7,000. With the new compressor upgrade, the repair costs were expected to be lower; therefore, management approved the upgrade. The post-project data shows repair costs did drop by $4,680 per year, which is 76 percent more savings than the electrical savings alone.

Here are the results summarized from a management perspective of payback periods calculated with and without maintenance costs:

One important question to ask is why the maintenance costs were reduced so dramatically.

It was discovered that the new, smaller compressor ran only when under load, whereas the old compressor ran continuously even when not under load. The lower run time meant that the compressor experienced less wear and, therefore, needed much less maintenance, as seen in the historical data.

This is a very important point for energy upgrades. While companies want energy savings, they also need to push for equipment that runs less often and with lower repair costs. Energy savings is just a fraction of the overall financial rewards of energy upgrades.

Case 2: Office Lighting Upgrade Eliminates Need for Second HVAC

A company experiencing business growth needed to expand its office space by 50 percent, and a contractor quoted a new $13,000 HVAC system for the expansion zone to supplement the existing system.

The energy team researched the cooling load of the extra office space and found the old T12 fluorescent lighting required a minimum 5-ton HVAC system to cool the office. They also found that the company had previously rejected upgrading the lighting due to poor payback.

Along with this data, the team also incorporated into their research the paradigm that for every 100 kilowatts of lighting in an area, there is an additional 33 watts of cooling required to cool that area lighting. The team determined that newer T5 fluorescent lighting and zoning of office lights would cut the current cooling load associated with cooling lighting by more than 80 percent.

This led to the conclusion that the company did not need the second HVAC unit, and also that the current older system could handle both office areas with ease. The company upgraded the lighting, avoiding the $13,000 HVAC cost completely.

That savings covered the cost of the lighting upgrade, and also resulted in future energy savings. In addition, this meant that the current HVAC system would have lower maintenance costs because it ran less frequently because of the lower cooling load.

Finally, the new T5 lights also cost the company less because they run less often in the new zoning system and require less frequent bulb replacement. This simple project benefited the company dramatically in so many ways.

If an energy-saving project is based solely on how much energy it will save the company, management will have less reason to approve the energy upgrade. Yet, when the manufacturer becomes aware that maintenance savings and avoided costs resulting from an energy retrofit often exceed the utility savings, it can calculate more realistic payback periods, which allows the company to reap the full benefits of energy-saving projects.

Those benefits will show up on the company’s income statement as lower maintenance and utility costs, leading to measurably higher profits. This is good news, and makes energy upgrades meaningful to any business.

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Trending Articles

- Industry Events

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI

17th annual Joint Open House

- May 8 - 9, 2024

- Oakville and Mississauga, ON Canada

MME Saskatoon

- May 28, 2024

- Saskatoon, SK Canada