- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

What will Sandvik's CNC Software acquisition mean for users?

The industrial engineering group flexes its muscle in the CAM and smart software space with new purchases

- November 26, 2021

- Article

- Automation and Software

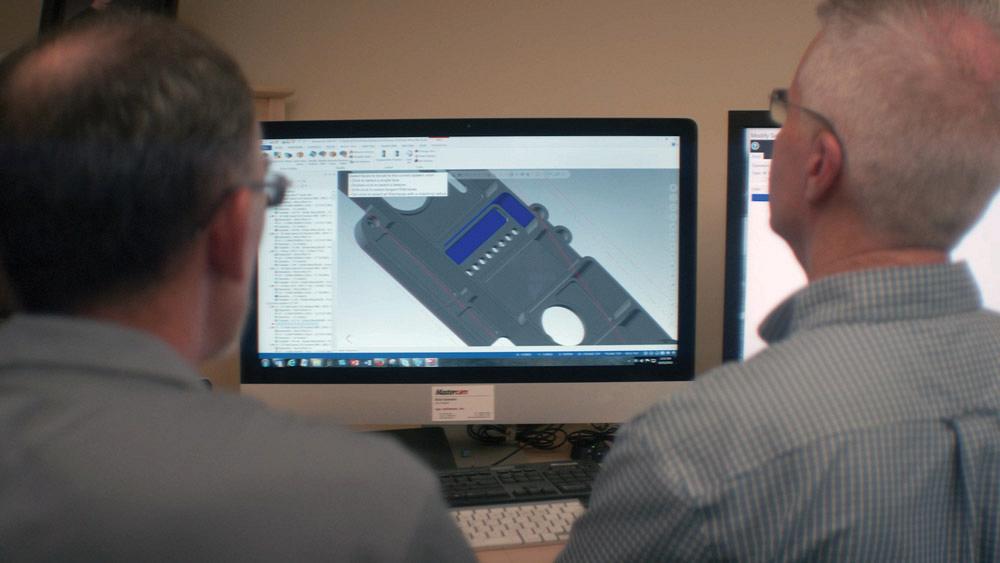

In the summer of 2021, Sandvik acquired several companies including Mastercam developer CNC Software. Sandvik

This summer was a big one for the Stockholm, Sweden-based Sandvik. The industrial engineering giant has spent the last few months announcing some of its latest acquisitions, including metrology provider DWFritz Automation, CAD/CAM software developer Cambrio, round tool manufacturer Fanar, and most recently, Mastercam developer CNC Software. This latest acquisition pushes the company further into the CAM market but has left many wondering what that means for Mastercam users.

Mathias Johansson, president of design and planning automation for Sandvik Manufacturing and Machining Solutions, and Meghan West, CEO/president of CNC Software, answered several hot-topic questions.

Canadian Metalworking: Why was this a good time for Sandvik to acquire CNC Software?

Mathias Johansson: The objective of Sandvik is to outperform market growth with industry-leading solutions, both organically and through acquisitions. Sandvik identified Cambrio and CNC Software as part of a long-term strategic view that is beneficial to each company.

The investment is to enable accelerated growth of the Design & Planning Automation Division. We have identified computer-aided manufacturing (CAM) as a key market for Sandvik to enter due to its attractive growth rates and its proximity to Sandvik Manufacturing and Machining Solutions’ core business, allowing Sandvik to establish a leading position within digital manufacturing.

We see a direct customer demand for more automated and integrated machining recommendations and solutions. Having CAM in the portfolio will help us meet such demand and further establish Sandvik as the preferred partner and leader within machining, while at the same time driving our long-term goal to becoming a trusted provider of digital manufacturing solutions for small and mid-sized enterprises (SMEs).

Meghan West: We have been pioneering CAM software for nearly 40 years. In that time, we have gotten a lot of offers, but none of them held much interest for us. Our primary driver has been—and continues to be—a focus on helping shops solve their manufacturing problems.

If we were going to consider an acquisition, we wanted to ensure that everything that benefitted our customers remained intact—and that any acquisition offered significant opportunity for us to accelerate and improve CAM development.

Sandvik offered a couple of critical pieces. First, they have a clear and deep-rooted focus on manufacturing. Second, their company philosophy is very similar to our own. We want to make sure decisions continue to be made as close to the customer as possible to ensure that we are addressing the right manufacturing issues. We have also partnered with Sandvik in the past, helping create cutter paths to properly drive their PrimeTurning tools.

As the industry accelerates and consolidation becomes much more common, Sandvik gives us the clear advantage of access to resources and manufacturing information that will help us stay at the top of the CAM market and continue to deliver innovative tools to shops worldwide.

CM: What is the vision and future for the acquisition? What will change and what will stay the same?

Johansson: The plan is for both Cambrio and CNC Software to continue to operate as separate business units within our Design & Planning Automation Division. We see both companies play important roles to help us drive and realize our strategic vision—to automate the manufacturing value chain for SMEs.

Sandvik has identified computer-aided manufacturing (CAM) as a key market for Sandvik to enter because of its attractive growth rates, said Mathias Johansson. Sandvik

With both these acquisitions still subject to closing or just having closed, we are of course at a very early stage. We believe in the strength of the individual products of each organisation which complement our current offerings and strengthen the Sandvik position to automate the manufacturing value chain.

West: One of our priorities was to make sure there was no disruption to the global Mastercam community. Management, development staff, officers, support staff, reseller channel, pricing, availability—everything is staying intact. From the customer standpoint, the only change they should see is better and better CAM tools in the years to come.

One remarkable thing about Sandvik is that they acknowledge the reality of open systems and multi-brand shops. It’s rare that a shop uses just one software, machine tool, or brand of tooling. To really be effective, manufacturing solutions need to remain as open as possible to allow shops to use what fits their needs. Sandvik embraces this, encouraging our existing and future wide-ranging partnerships.

CM: How will Sandvik support multiple or competing CAM software brands under one umbrella?

Johansson: Cambrio’s GibbsCAM and CNC Software’s Mastercam each have strong positions within their respective customer segments and markets with loyal customer bases, which we believe will remain and grow for years to come.

GibbsCAM specialises in the more complex machining niches like Swiss machining and mill turning, while Mastercam is a more intuitive and broad-based solution.

Cambrio also includes Cimatron for mold and die and SigmaNEST for strong material utilisation and nesting efficiency.

West: While Sandvik and its subsidiaries can provide a base of resources we can leverage within Mastercam, the need to maintain customer efficiency and address different issues remains. This means that for now, these products serve distinct needs, and any potential technology partnering would primarily be addressed company-to-company between business units under the Sandvik umbrella.

It’s also important to note that our data integrity remains intact. Our customer data remains with us, meaning other companies under the Sandvik umbrella do not have access to our customer data and vice versa.

CM: What excites you about the future of the CAM market?

Johansson: The acquisitions strengthen Sandvik’s position within digital machining and manufacturing. The CAM portfolio, in combination with our existing offerings and extensive manufacturing capabilities, will make Sandvik a leader in the overall CAM market measured in installed base.

Already a market leader in machining solutions, we think the experience and knowledge we have in that field will help us develop an Industry 4.0 position in the advanced metal component manufacturing industry.

With the acquisition, CNC Software wanted to make sure decisions continue to be made as close to the customer as possible to ensure that it is addressing the right manufacturing issues, said Meghan West. CNC Software

It is important also to add that we remain fully agnostic and able to integrate with other CAM solutions.

West: We are excited to integrate some of the manufacturing information this acquisition makes available to us. But even more exciting is that our vision lines up closely with Sandvik’s drive for automation and digitalization. We are looking to move both deeper into the automation of existing machines, but also broader in terms of better and finer control of the growing number of the incredibly sophisticated machines that are coming onto the market.

This is an exciting time for CAM, and we couldn’t have asked for a better partner with whom to move into the future.

CNC Software, www.mastercam.com

Sandvik, www.sandvik.com

Related Companies

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Industry Events

MME Saskatoon

- May 28, 2024

- Saskatoon, SK Canada

CME's Health & Safety Symposium for Manufacturers

- May 29, 2024

- Mississauga, ON Canada

DiPaolo Machine Tools Open House 2024

- June 4 - 5, 2024

- Mississauga, ON Canada

FABTECH Canada

- June 11 - 13, 2024

- Toronto, ON Canada

Zoller Open House & Technology Days 2024

- June 12 - 13, 2024

- Ann Arbor, MI