Manager of Labour Market Research

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Canada’s additive manufacturing ecosystem is at a crossroads

Just press print

- By Maryna Ivus

- October 4, 2021

- Article

- Metalworking

Canada’s additive manufacturing (AM) ecosystem is at a crossroads as technological advances and global market trends drive AM growth worldwide at an estimated 24 per cent per year to an expected US$35 billion by 2024. Canada has the potential to ride that growing wave, but there’s no guarantee that it will.

Canada has a diverse AM ecosystem that boasts several world-renowned firms. It has had notable success in niche areas such as metal powder feedstock, metal AM research, and applications in aerospace and health sciences.

However, Canadian AM also faces challenges, such as slow industry adoption because of capital investment costs and uncertain ROI. The country also stands in the shadow of much bigger AM players like the U.S., Germany, and China—countries on which Canada currently depends for most of its AM machinery and supplies.

The Study Says …

A new Information and Communications Technology Council (ICTC) study, “Just Press Print: Canada’s Additive Manufacturing Ecosystem,” takes a deep dive into the world of AM, examining the technology’s advantages and limitations and looking at its applications in key sectors. The study discusses Canada’s strengths and weaknesses in the global context, its companies and supporting industry bodies, educational institutions, in-demand AM roles, and the impact of COVID-19.

For Canada to remain a competitive player in the global AM market, the study suggests it will need “a strong, focused strategy, and a set of industry-focused policies that exploit AM strengths.”

Because Canada is a small power in the global AM ecosystem, which currently is dominated by the U.S., the European Union, and China, the Canadian government is supporting the industry through numerous research councils, accelerators, and funding programs.

Study participants voiced general optimism regarding the future of AM in Canada, but still identified numerous challenges.

Growth of AM

Analysts are expecting the AM market to grow 20 to 30 per cent annually for the next few years. This growth will include growth in the current AM market, which in Canada typically means small-batch manufacturing, customization, repairs, spare part manufacture, and even some large-batch serial production.

As a comparison, the value of all AM products and services worldwide grew by 21.2 per cent in 2019 to a total of US$11.87 billion. Globally, the percentage of businesses surveyed by EY that have tried AM technology rose to 65 per cent in 2019 from 24 per cent in 2016.

Canada’s Place

Globally, AM is highly centralized in Europe and the U.S. Europe contains more than half (55 per cent) of the world’s AM firms, the Americas have 32 per cent, and Asia has 13 per cent.

Canada represents about 2 per cent of the global AM ecosystem.

“I consider the AM industry [in Canada] to be in its infancy. I think you would be hard-pressed to find 100 additive-focused companies in Canada. Only 20 to 30 of them are on a vaguely industrial level. There are probably less than 1,000 people in Canada who are truly knowledgeable about AM.”

– Survey responder, executive, AM consultancy (Ontario).

Canada’s AM Strengths

The Canadian AM ecosystem is relatively diverse, and in many AM-related areas it possesses a well-integrated value chain (such as in powder manufacturing), strong expertise (in robotics, AI, CAD file management, printer manufacturing), or has seen wide adoption (in aerospace and biomedical).

Quebec, in particular, is a leader in metal AM research and powder development.

An example of an additive-focused company is Winnipeg’s Precision ADM, which has been Canada’s largest manufacturer of 3D-printed medical devices during the COVID-19 pandemic. Medical AM is an area of significant achievement and high growth potential, which has benefited from high engagement from universities and industry, according to the survey.

“We chose to work with AM because it enables us to operate with existing parts. We can reduce the amount of machining necessary on parts. It simplifies a range of processes. And large parts can be printed from scratch. We can manipulate our material in a more complex way.”

– Survey responder, AM specialist, manufacturing (Quebec).

The Role of Government

Study participants consider the federal government to be the most relevant player in supporting the growth of the AM ecosystem in Canada. In 2018 the federal government pledged to invest up to $230 million in the Next Generation Manufacturing Supercluster (NGen) to make Canada a world leader in advanced manufacturing.

The National Research Council’s Industrial Research Assistance Program (IRAP) also includes a Metal Additive Program, which provides grants of up to $5,000 per project to conduct feasibility studies in metal AM, or up to $10,000 to hire a qualified service provider to design and manufacture a metal AM prototype.

Canada offers a large network of education and research institutions for those interested in AM. Survey participants expressed a general degree of satisfaction with the quality of graduate-level programs and the talent they produce.

“The biggest thing the government can do is work on public perception. Public perception is that 3D is only good for prototyping and can’t produce final-use parts. The government can help spread the word that there are more capabilities than that.”

– Survey responder, executive, AM consultancy (Ontario).

Challenges for Canadian AM

- Slow adoption of AM attributed to a risk-averse business culture in Canada.

- High upfront setup costs.

- The inability to rapidly certify AM parts.

- Fragmentation and lack of communication among key players in the AM industry.

- General lack of understanding of what AM can do.

- A relatively small supply of skilled AM professionals.

- AM professionals require a mix of technical knowledge, industry experience, and soft skills.

“AM doesn’t give you many advantages if you do not know how to design things for AM. I believe that now the largest challenge is that there's a fundamental lack of design skills to leverage these technologies, and that's holding back the usage of the technology. We also need to create smarter tools and smarter instruments.”

– Survey responder, executive, AM software (Ontario).

In-demand Roles

According to the ICTC, 15 technical roles currently are in high demand at AM manufacturers:

- AM engineers

- Manufacturing engineers

- Mechanical engineers

- Materials engineers/scientists

- Application engineers

- Process engineers

- Project engineers

- Software engineers

- Software developers

- Design engineers

- Product design engineers

- Designers

- 3D printing/AM technicians

- Engineering technicians

- Machinists

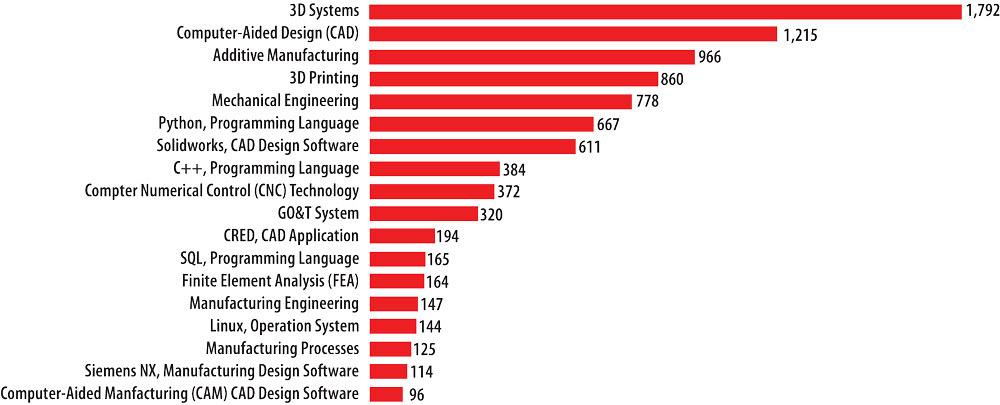

Partial List of Key AM Skills

When it comes to skills, the survey respondents identified numerous programming and design software skills that are in demand.

Action Ideas for the Canadian AM Market

- Build greater awareness of AM technology and its applications among businesses and educational institutions.

- Increase incentives to adopt disruptive technologies.

- Increase Canada’s R&D expenditure.

- Fund the creation of specialized scientific research institutes across Canada.

- Encourage and incentivize large, domestic firms to think “big” and adopt AM and Industry 4.0 as a means of remaining competitive internationally in the long term.

- Push for international educational partnerships in AM research.

- Increase educational investments in AM research.

- Take on more ambitious projects that increase the profile of AM in Canada.

Maryna Ivus is manager of labour market research at Information and Communications Technology Council (ICTC), 116 Lisgar St., Suite 300, Ottawa, Ont. K2P 0C2, 613-237-8551, www.ictc-ctic.ca.

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI