- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Keeping your edge

Canny tech investments keep mouldmaker on top of its game

- June 3, 2011

- News Release

- Metalworking

It has been a long, hard decade for Canada’s mouldmakers. Offshore competition, fluctuating currency values and a recession combined to turn the industry on its head. We asked Tony Grossi, president of Garrtech Inc. in Stoney Creek, ON, how his company weathered the storm.

“Mouldmakers have been kicked in the teeth,” he says. Many Canadian and US competitors exited the business, while others dramatically downscaled their operations. Garrtech’s strategy has been ongoing investment in technology to help protect margins.

The firm was founded in 1991 and has 2,787 sq m of shop space. About 80 per cent of Garrtech’s business is blow moulds for the packaging industry, including moulds for PET. The rest comes from HDPE moulds for the industrial and automotive sectors. Most of its customers are in the US. It currently has 47 staff, but Grossi says that 52 would be a better number in terms of current workloads if he could find the right people.

Low-cost offshore competitors, especially from China and India, were once a predominant concern for the Canadian industry. That situation has improved slightly, says Grossi. Many North American customers experienced unexpected quality problems and delays in delivery from these suppliers. When total costs were considered, the savings were not there—especially on the high end technical tooling, moulds and blow moulds. In addition, as domestic demand and quality requirements increase overseas, the competition’s costs are rising.

The recovery is now underway, a fact reflected in higher levels of activity among Garrtech’s customers and in bigger and better projects, says Grossi.

There’s a downside, though—the strong Canadian dollar. While it means that the firm can buy production equipment at a good price, it impacts selling prices. Compared to four years ago, Grossi says that Garrtech is delivering tools and components for 30 per cent less in real terms.

Compounding matters, material costs have been climbing as selling prices drop. The company mainly works with aerospace-grade aluminum and crucible and stainless steels. Grossi says materials account for 25 per cent of the cost of most jobs and reached 50 per cent on one recent job.

Tight lead times are another factor. The lead times for unit tools are normally around five weeks, while production tools can have a five to six week lead time from date of approval. “We have really had to compress deliveries,” says Grossi.

The combination of staff shortages, thin margins and tight lead times is today’s reality in this sector.

Since prices are not moving upwards and most other costs are increasing, lowering the cost of production is the main variable the firm can use to maintain its margins.

Machine uptime is a cornerstone of meeting tight deadlines, cost efficient production and high quality. The firm has implemented a monitoring system from Lemoine Multinational Technologies Inc. of Walled Lake, MI. The PULSE (Performance Utilization of Systems & Equipment) system monitors the machines, providing management with real-time operating data including idle times, feed rates, component name, operation type, operation length and others.

When they started working with the system, the uptime data they obtained was “not very impressive,” says Grossi. “We were typical of a lot of machine and mould shops.” They were often getting 30 or 40 per cent machine utilization and quickly made it a goal to get to 60 or 70 per cent.

The question was, why were machines that had an operator during a regularly scheduled shift not up and running? “It points to a number of things: people, material availability, setups, and more importantly in our situation right now, programs,” says Grossi.

One element the PULSE system quickly identified was the need to dispose of three older machining centres. Downtime related to repairs was impacting the production flow significantly. As Grossi notes, getting rid of them was not a complex decision.

A more difficult problem is staffing. “There’s one sure sign that the economy is turning around. We’re having trouble getting good people—programmers and designers, especially,” says Grossi.

They have two apprentices at present, one in mouldmaking and the other on the machining side. “As we get more confident that the market is moving in the right direction and we can afford to carry more rookies, we’ll do it,” says Grossi.

Good programmers and designers are a particular need. The company maintains a distinctive suite of specialized software applications. For example, they rely on Unigraphics, PowerMill and several other packages that students don’t get much exposure to in their classes.

A good programmer has to be familiar with the business’s manufacturing methods, with its workflow, machining preferences and setups. Students fresh out of school face two challenges: they have to learn both the company’s methods and the new software.

Garrtech decided to train some of its machinists as programmers. That will eliminate one of the obstacles. “The machinists know what we’re doing and how the machines work,” says Grossi. “Now, we just have to get them going on the software.”

The company’s experienced programmers will handle the training. Grossi estimates that it will take two or three months before the trainees are paying dividends in programming and providing good, reliable programs.

It’s a job with some time pressure. When Garrtech gets files from customers, they often need to clean them up. “Things might be missing, so we resurface that model and send it back to the customer for approval,” he says.

The moulding surfaces are then defined and go to programming. “It involves moving from one piece of software to another, tracking revisions and making sure the latest files are saved,” says Grossi. “We do a decent job of this, but we need to take it to the next level, integrating one CAD/CAM system.”

The machining operation is also slated for an upgrade.

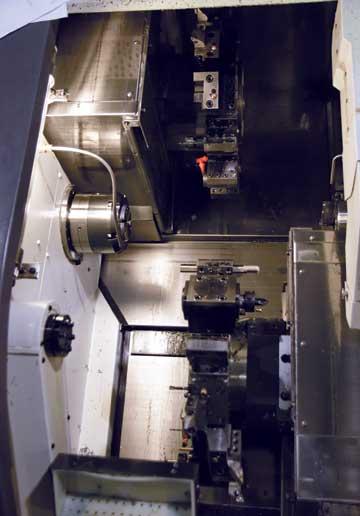

Garrtech has 19 machining centres, including some sophisticated five axis units. The most recent is a Matsuura MAM 72-63V PC2, acquired about four years ago. Five axis work is probably 30 or 40 per cent of the business, says Grossi. These machines typically run at spindle speeds of 18,000 to 20,000 rpm. Toolholders are normally determined in consultation with the supplier of a new machine tool in light of Garrtech’s specific requirements. The firm has a fully equipped tool crib and a variety of cutting tool systems and cutting fluids have been used.

The change in five axis machining technology has been dramatic, says Grossi. One key concern will be the machine’s pallet capabilities. The newest five axis machines have two pallets, and reducing setups is a key objective to increasing machine uptime. “The next generation machines coming in here will be fully equipped with multi-pallets,” says Grossi, maybe five or ten per machine. Matsuura is definitely on the short list of potential suppliers, he says. The machines are “very robust, and Elliott Matsuura services us well.”

“You want to maximize unattended machining as much as you can,” he says. “We’re trying to get to that next level—lights-out, unattended operations.” The firm is currently capable of a certain amount of overnight, unattended operation on its machining centres.

He quickly adds that Garrtech is “a couple of years” away from anything approaching a lights-out environment, and that much larger companies have had a difficult time with this strategy.

“I don’t know of too many companies that are running 24/7, unless they’re very specialized,” he says. But increasing the percentage of unattended operation is feasible. “In theory, you can run virtually unattended for two shifts,” he adds, running the machines 14 to 20 hours a day. It’s a matter of economics for such sophisticated technology. “When you look at the cost for this machinery, it needs to run night and day.”

Another initiative is a proprietary laser-cladding process Garrtech is developing in partnership with National Research Council Canada.

Wear surfaces made from beryllium copper are used on aluminum moulds to trim the bottoms of bottles, since aluminum lacks the compressive strength to be used productively for this purpose. The laser cladding will allow a hardened steel wear surface to be applied to the moulds without separation between the two metals. That will result in a one-piece mould, eliminating cooling problems and permitting better cycles for the customers.

“From a manufacturing point of view, it’s really too early to see whether this is going to translate into cost savings of our moulds,” says Grossi. “In theory, we’re eliminating additional components, but it is more expensive to laser-clad. Right now, laser cladding is still in its infancy and we will be more efficient in a year’s time.”

The project began about three years ago and the first, on-site test was done a few weeks ago.

Garrtech is innovating in other areas. The economic pressures in the mouldmaking industry have led many firms to diversify. Garrtech has leveraged its expertise in machining aluminum to making flexible support arms for monitors, like TVs.

“Typically, mouldmakers in years gone by were happy just making moulds,” says Grossi. “Now, some of us are saying that we need to bring more to the table or we need a second product line, outside of mouldmaking.” Diversification protects the firm economically. “We can no longer let our main product line—our core business—put us in jeopardy moving forward.”

The Monitors in Motion division of the company has North American rights to manufacture and sell a product line designed by a partner firm in the United Kingdom. It also developed an iPad holder that permits these devices to be mounted in hospitals, factories, vehicles and so on.

In fact, business on both sides of the company is growing to the point that scheduling machining time has become something of a challenge.

The lesson seems to be clear. Many mouldmakers that didn’t keep their technological edge aren’t around anymore. Innovation is the lifeblood of any business, and you can’t stand still. A unique opportunity to invest currently exists because of the strong Canadian dollar. “This is the year to make the investments,” says Grossi. “Both our markets are growing and we’re getting ready.” CM

Jim Barnes is a Toronto-based writer and a former editor of Canadian Metalworking.

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Trending Articles

Automating additive manufacturing

Sustainability Analyzer Tool helps users measure and reduce carbon footprint

CTMA launches another round of Career-Ready program

Sandvik Coromant hosts workforce development event empowering young women in manufacturing

GF Machining Solutions names managing director and head of market region North and Central Americas

- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI