- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

New products will help drive stronger second half results: Ski Doo maker BRP

Products include new model snowmobiles, new all-terrain vehicles like the Outlander and new outboard engines.

- September 15, 2014

- News Release

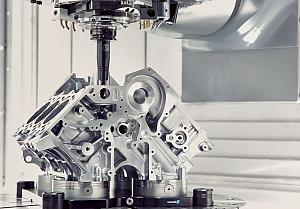

- Metalworking

![By Melensdad at en.wikipedia [GFDL (http://www.gnu.org/copyleft/fdl.html), CC-BY-SA-3.0 (http://creativecommons.org/licenses/by-sa/3.0/) or CC-BY-2.5 (http://creativecommons.org/licenses/by/2.5)], from Wikimedia Commons](https://cdn.canadianmetalworking.com/import/2014/09/2007_Bombardier_XRS_800.jpg?size=1000x)

By Melensdad at en.wikipedia [GFDL (http://www.gnu.org/copyleft/fdl.html), CC-BY-SA-3.0 (http://creativecommons.org/licenses/by-sa/3.0/) or CC-BY-2.5 (http://creativecommons.org/licenses/by/2.5)], from Wikimedia Commons

MONTREAL — BRP Inc. says it expects a string of new product launches will drive the recreational products company to a stronger second half following a money-losing second quarter.

"Our first half of the year is more difficult than originally planned but our second half will be stronger than planned,'' BRP CEO Jose Boisjoli said during a conference call with analysts Friday.

The Quebec-based maker of Ski-Doo snowmobiles and Sea-Doo personal watercraft said new products that will only begin shipping in the third and fourth quarter include new model snowmobiles, new all-terrain vehicles like the Outlander and new outboard engines.

It also unveiled a new Can-Am off-road four-wheeled vehicle Friday and said it would launch a new Spyder Roadster highway three-wheeler on Sept. 23.

BRP had a $3.6-million net loss or three cents per diluted share in the three months ended July 31. That compared with a net loss of $7.9 million or seven cents per diluted share in the year-earlier period.

Excluding one-time items, BRP had an adjusted loss of $8.8 million or seven cents per share in the second quarter, compared with an adjusted profit of $7.6 million or seven cents per share in the prior year. BRP had been expected to report eight cents per share in adjusted profit, according to analysts polled by Thomson Reuters.

BRP said the $16.4-million year-over- year decline in adjusted earnings was primarily due to increased costs of sales and marketing, the ramp-up of production at a Mexican factory and an unfavourable foreign exchange variation of $10 million.

Revenues were $780 million, up from $620.9 million cent year-over-year and well above expectations of $705.5 million. The increase was mainly due to higher sales in seasonal and year-round products along with an increase in sales of related parts, accessories and clothing.

International sales increased eight per cent, despite the challenges in Russia and a soft economy in South America.

Revenues from seasonal products such as Ski-Doos and Sea-Doos increased 84.8 per cent to $259.8 million for the three-month period ended July 31.

The recovery from a soft start to the year was driven by the new entry-level Sea-Doo Spark and higher volumes of snowmobiles for the upcoming season. BRP said the Spark should generate around $125 million in revenues, up from its original forecast of $65 million to $70 million.

Revenues from year-round products, such as off-road vehicles, increased 6.9 per cent to $297.4 million in the quarter. Higher promotional rebates drove shipments of Can-Am side-by-side vehicles while sales also increased for all-terrain vehicles.

Propulsion revenues decreased 1.7 per cent to $84.4 million due mainly to lower sales of outboard engines. Revenues from parts, accessories and clothing increased 19 per cent to $138.4 million.

The company maintained its outlook for full-year adjusted earnings to grow by 10 to 17 per cent to reach $1.55 to $1.65 per share as total revenues increased by nine to 13 per cent.

Benoit Poirier of Desjardins Capital Markets described the second-quarter results as a ``non-event'' but said investors will remain skeptical about whether BRP can achieve that guidance.

Meanwhile, the analyst said the new turbo-charged Can-Am Maverick unveiled Friday is a direct response to the Polaris RZR XP 1000 launched in the summer of 2013.

"While weight and price specifications are not available, we believe this product will be well received by customers and dealers,'' he wrote in a report.

Cameron Doerksen of National Bank Financial questioned if the company is being realistic in maintaining its full-year guidance requiring a 48 per cent boost in EBITDA in the second half of the year.

"While this appears to be aggressive, we (also) think it is potentially achievable,'' he wrote.

The analyst sees strong growth in the powersports industry, improving consumer confidence that will drive spending and a better second half that should help BRP's stock price.

On the Toronto Stock Exchange, BRP's shares set a new 52-week low of $24.87 before closing down 94 cents or 3.64 per cent at $24.91 on Friday.

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Industry Events

ZEISS Quality Innovation Days 2024

- April 15 - 19, 2024

Tube 2024

- April 15 - 19, 2024

- Düsseldorf, Germany

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada