Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Italy aims to boost Industry 4.0 investments with government support

Funding model may be a useful template for Canada

- By Rob Colman

- May 30, 2017

Massimo Carboniero, President of UCIMU - Sistemi per produrre, addresses a press conference at Lamiera 2017.

At the invitation of the Italian Trade Agency and UCIMU – Sistemi per produrre (Italy’s machine tool, robots, automation systems and ancillary products (NC, tools, components, accessories) manufacturers' association), I joined six representatives of Canadian manufacturing companies on a visit to Lamiera in May. Lamiera is Italy’s metal forming tradeshow, which was being held for the first time in Milan (it was previously held in Bologna).

The show included 480 exhibitors, a substantial increase of 25 per cent from last year’s show.

The Canadian manufacturers I had a chance to speak to were primarily keen on finding automation systems and software that could help them further increase production speeds and improve the flow of information throughout their facilities. Everyone wants a smarter manufacturing floor; it’s a matter of finding the right technology to fit that need.

It was fitting, then, that the focus of most booths at the show was on Industry 4.0. This isn’t particularly surprising, considering the push for greater machine and information connectivity among all aspects of the shop and supply chain has been a hot-button topic in Europe for several years now.

The difference in 2017 is that the Italian government is keen to push local companies to adopt this technology to make the country’s manufacturing sector more competitive. At least one exhibitor noted the first thing that people asked when sitting down to talk about technology was, “Is your equipment Industry 4.0-ready?” because they know they can benefit from government incentives if they invest effectively in these technologies.

The reaction from industry has been enthusiastic. In a press conference at the show, Massimo Carboniero, President of UCIMU, noted that with these incentives the government has recognized the need to put manufacturing at the centre of its investment strategies.

Italy’s 2017 Budget Law introduced new tax incentives and increased existing incentives for companies investing in technological and digital systems that fit the Industry 4.0 model. These incentives include hyper-depreciation on tangible operating assets and super-depreciation on intangible operating assets, tax credits for R&D, and support for SMEs and innovative startups.

The law allows a 250 per cent tax benefit on the purchase of certain tangible assets related to Industry 4.0 and a 140 per cent tax benefit on the cost of certain intangible assets (software and development/system integration) related to investments in Industry 4.0 tangible assets.

Investments eligible for these incentives will be those made by the end of December this year or June 30, 2018, provided that the seller accepted a purchase order and advances of at least 20 per cent of the purchase cost will have been paid before end of December 2017. So it makes sense that local companies would be keen to invest sooner rather than later.

Tax credits for R&D include 50 per cent of the expenditure that exceeds the average R&D investments made by companies between 2012 and 2014, up to 20 million euros per year. There is also a provision for tax deductions of up to 30 per cent for investments of up to 1 million euros in startups and SMEs.

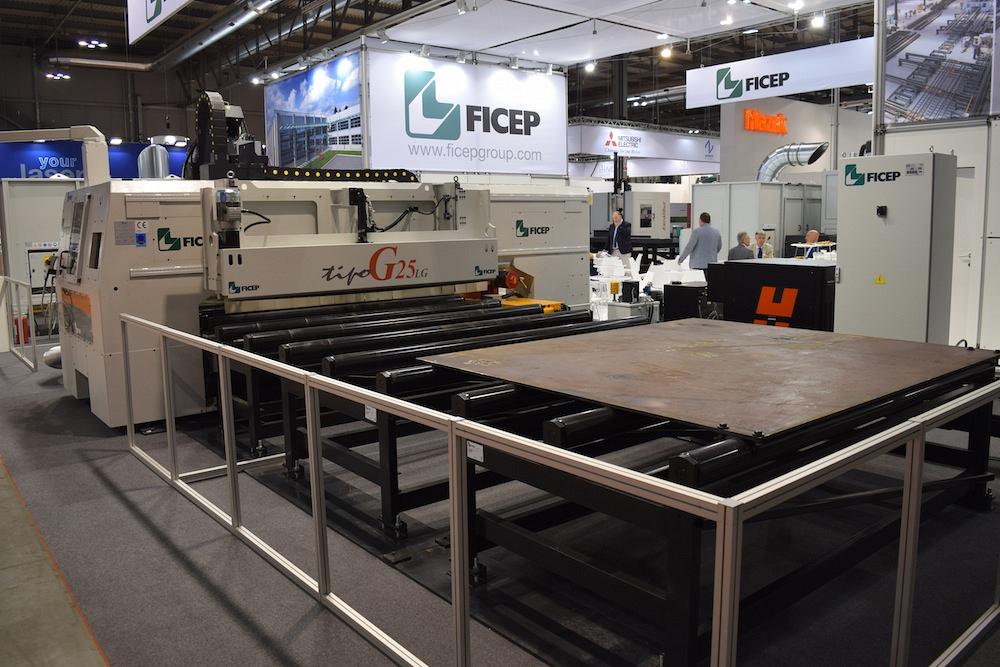

Ficep's Tipo G25LG on the show floor. The Tipo G is an automatic CNC drilling, milling and thermal cutting system for plates.

This move to encourage prompt investment in this technology seems ambitious. The government hopes it will encourage faster turnaround from prototyping to mass production of products using innovative technologies, increased productivity, improved quality (scrap reduction based on advanced production monitoring, for instance), and higher competitiveness for Italian companies.

In some ways, Canada isn’t so different from Italy. Our industrial sectors are similar in the sense that they are primarily small and medium-size enterprises. Our R&D capabilities are similarly strong. The combination of the two should allow us to be nimble innovators, especially when armed with the newest communications technology on and off the factory floor.

The Canadian government may yet learn something from the example set by Italy. I look forward to seeing how the nature of technology investments is altered in 2017 in the market with this support model. Incentives of this type are only valuable if the companies targeted by them can develop coherent plans to make the investments being encouraged. And on the administrative side, determining what kind of investment fits the “Industry 4.0” moniker might be more difficult than it seems. However it is at least defined, rather than being a blanket capital investment incentive, which is what I consider a positive innovation.

Editor Robert Colman can be reached at rcolman@canadianfabweld.com.subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free SubscriptionAbout the Author

Rob Colman

1154 Warden Avenue

Toronto, M1R 0A1 Canada

905-235-0471

Robert Colman has worked as a writer and editor for more than 25 years, covering the needs of a variety of trades. He has been dedicated to the metalworking industry for the past 13 years, serving as editor for Metalworking Production & Purchasing (MP&P) and, since January 2016, the editor of Canadian Fabricating & Welding. He graduated with a B.A. degree from McGill University and a Master’s degree from UBC.

Related Companies

- Trending Articles

CWB Group launches full-cycle assessment and training program

Achieving success with mechanized plasma cutting

3D laser tube cutting system available in 3, 4, or 5 kW

Brushless copper tubing cutter adjusts to ODs up to 2-1/8 in.

Welding system features four advanced MIG/MAG WeldModes

- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI