- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

It’s a new day for mouldmaking

Industry copes with tariffs, trade deals, technology, and demographics

- By Nate Hendley

- February 27, 2019

- Article

- Metalworking

One of the biggest manufacturing stories of 2018 was General Motors’ decision to shutter its Oshawa, Ont., assembly plant, along with some U.S. operations, by the end of 2019. The closure, announced Nov. 26, 2018, represents a new challenge for die/mould shops already coping with tariffs, trade deals, aging workers, and the cost associated with adding new technology.

The announcement, however, was long anticipated (the Oshawa plant has only 2,500 employees at present and is operating far below full capacity). Also, most Canadian-made moulds are exported, which somewhat softens the blow.

“Obviously, this will impact our industry as a whole. For us personally, it all depends on where GM will manufacture vehicles. We currently send tools to Toronto, the U.S., and Mexico for many GM vehicles. We service the Tier 1 moulders and they could be anywhere,” said Toni Hansen, president of Aalbers Tool & Mold in Oldcastle, Ont.

The closure will have both a direct and indirect impact on the mould sector, said Jonathon Azzopardi, chairman of the Canadian Association of Mold Makers (CAMM) and president and CEO of Laval, based in Tecumseh, Ont.

“We probably won’t feel much direct impact from it because we don’t really don’t depend on the domestic market as much as people would think. Seventy per cent of what mouldmakers make will land on an automotive vehicle [and] between 75 and 85 per cent of that is exported to the U.S.,” said Azzopardi.

The remaining percentage is divided up among Canada, Mexico, Europe, and Asia.

“But you can see that Canada really is a small piece of the pie. That’s direct impact. Indirect impact is where the waters get a little bit muddier,” he added.

Indirect impacts of the closure include not only ancillary contracts, but also the notion that manufacturing is declining in Canada -- a false assumption that might sway government policies and public perceptions at a time when the sector faces a skilled labour shortage, said Azzopardi.

“So we think the long-term, indirect impact will be far worse than the direct impact,” he said.

Trade squabbles hinder industry

On the political front, the so-called trade war between the U.S. and Canada is also having an impact. In 2018 the U.S. government slapped a 25 and 10 per cent tariff on imports of steel and aluminum, respectively, making it costlier for Canadian firms to ship these materials south of the border. In return, the federal government imposed retaliatory tariffs against American steel and aluminum. Given the export-driven nature of the mould sector and cross-border demand for raw materials, none of this was welcome news.

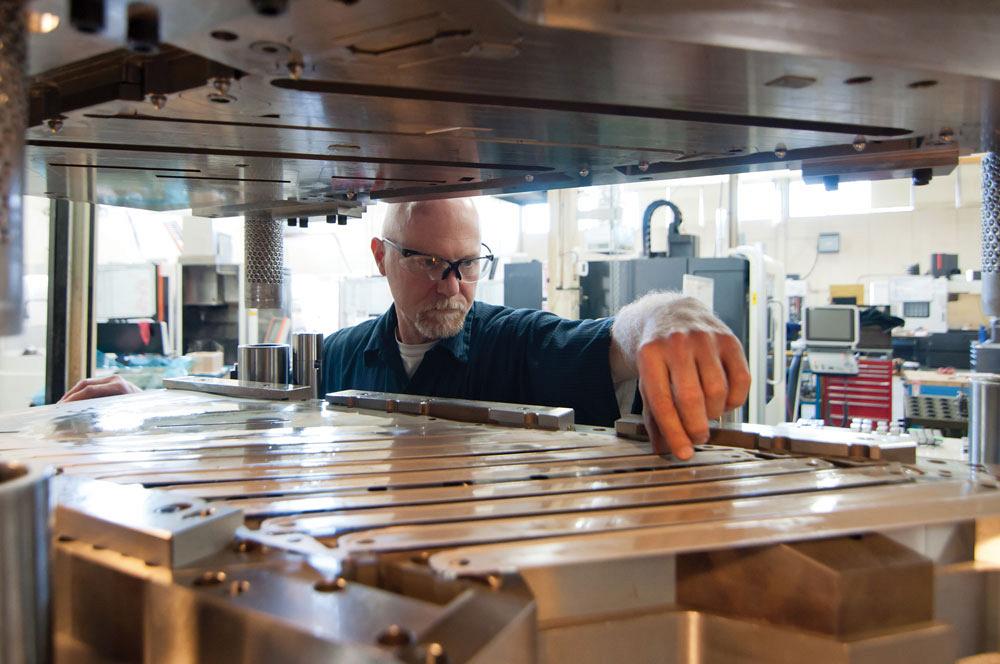

Like many other sector, new technology and automation will play a lead role in the future of the Canadian mouldmaking industry. Photo courtesy of Cavalier Tool & Manufacturing.

Ottawa needs to understand its own tariffs are causing the problems not solely in the U.S.

“In my industry alone, we cannot buy the metal that needs to be used in Canada, and it’s not feasible for us to bring it in from other countries,” said Azzopardi.

David Palmer, sales manager at Build-A-Mold, part of the Plasman Group, in Windsor, Ont., is equally unhappy with the situation and the retaliatory measures put in place by Ottawa.

“If we have to buy steel and aluminum from the States, obviously our costs have increased,” said Palmer, whose company designs and manufactures plastic injection moulds.

If tariffs weren’t enough, another economic challenge comes in the form of the new trade deal that is being called the United States-Mexico-Canada Agreement (USMCA) by some. Political leaders agreed to the pact, which is supposed to supplant NAFTA, in fall 2018 but it hasn’t yet been ratified.

How major manufacturers respond if and when the USMCA comes into effect will have huge ramifications on future contracts.

Surviving the shakeup

At a plant-floor level, there are measures that shops can take to survive these challenges. The pending GM closure, for example, highlights the issue of diversification and the need to move beyond the automotive sector and into markets such as aerospace and consumer goods. Entering new markets, however, presents its own challenges.

“We have always tried to build non-automotive tooling when possible. There is far less time waiting for data as well as payment. Unfortunately, much of the non-automotive tooling has gone to LCC (lower-cost countries) as the volumes are not as high as automotive in many cases,” said Hansen.

“We all talk about diversification, but every time the automotive industry is healthy, we jump right back on the bandwagon. Because with automotive there’s multiple tools, and these tools are good for a three- to five-year program,” said Palmer.

Roughly 95 per cent of Build-A-Mold’s business is based on the automotive market, he added.

Tariffs and trade squabbles increase raw material costs and create barriers for Canadian goods. Photo courtesy of The Plasman Group.

Laval, which specializes in injection and compression moulds, has successfully diversified, and performing work for clients in the marine, household items, and military sectors, in addition to automotive. The company also services moulds at clients’ sites, among other tasks.

Still, diversification is not an easy road.

“You will go many years trying to establish relationships in industries you’re not familiar with, with little to show for it,” said Azzopardi.

Easy or not, Cavalier Tool & Manufacturing in Windsor, Ont., has also successfully navigated this route.

“We only do maximum one-third automotive. We maintain diversity to not be subject to the ups and downs of the automotive market,” said Tim Galbraith, sales manager at Cavalier.

In addition to automotive, Cavalier has clients in the agricultural, consumer, and recreational vehicle sectors.

Become a global supplier

Diversification can also mean doing work in other countries, including selling products, setting up satellite operations, and securing new partnerships.

“You should be at least open to the idea of having some type of international exposure. I can’t say whether it’s a footprint, [sales] representative, satellite operation, joint venture, or an acquisition, but your aspirations have to be larger than North America for sure,” said Azzopardi.

For example, Aalbers runs a small Mexican service and repair operation, Build-A-Mold partners with Asian firms for producing tools, and Cavalier has a design centre in India.

“We can’t get enough designers in southwestern Ontario to satisfy the requirements,” said Galbraith. “Everybody who is smart is looking to other parts of the world.”

Cavalier Tool opens its doors for tours during Manufacturing Day to showcase its technology to other local businesses and to students wanting to learn about manufacturing. Photo courtesy of Cavalier Tool & Manufacturing.

CAMM also works hard to market Canadian mouldmakers to foreign clients and recently undertook a trade mission to India.

Of course, there are risks here too: Hansen, for one, is waiting to see how the USMCA might impact Aalbers’ Mexican operations.

Dealing with an aging workforce

Canada’s aging workforce represents an ongoing challenge. Azzopardi has written that the mould sector “is facing a demographic cliff” as existing mouldmakers retire and young people aren’t replacing them.

In response, several Windsor, Ont.-area companies have embraced Manufacturing Day℠, which is designed to encourage young people to consider manufacturing careers. On Manufacturing Day, plants and factories host open house events for students and other interested parties.

The Manufacturing Day event in Windsor, held Oct. 5, 2018, involved nearly 900 students.

“I think 17 different shops participated. My own shop had over 200 students visit. We also had federal [government] officials here during the visit,” said Azzopardi.

“Manufacturing Day is a big deal. Essex County in southwestern Ontario is probably five years ahead of a lot of communities in organizing it,” added Galbraith.

Cavalier does talks in local schools and hosts student tours throughout the year. The firm saw 500 young people walk through its doors in 2018, according to Galbraith. For Manufacturing Day, Cavalier handed out special brochures and T-shirts and set up a photo booth for visiting students.

Aalbers is tapped into the Ontario Youth Apprenticeship Program (OYAP), which gives Grade 11 and 12 students the opportunity to work as registered apprentices. The company also offers in-house training to OYAP students and pays for apprenticeships if students measure up, said Hansen.

New technology is key

If events such as Manufacturing Day address demographic challenges, then embracing new technology can be a way to head off competition from low-cost jurisdictions.

Diversification can also mean doing work in other countries, and example of which is a small service and repair operation that Aalbers runs in Mexico. Photo courtesy of Aalbers Tool & Mold.

“If you don’t have CNC machines, if you don’t have CAD/CAM software, you’re not in business. Those are the bare-bones necessities. What you need now is Industry 4.0. What you need now is the internet of things. You need machines talking to one another, you need robotics, you need automation, you need cameras. Technology/automation is going to be the future of our industry,” said Galbraith.

“If you are not using the latest and greatest machines and software, you will be left behind. That’s certain,” said Hansen, whose company uses palletized machines, CNC machines, robotic loaders, and 5-axis machines to maintain timing and quality.

According to Azzopardi, his company uses robotic systems and has been doing experiments with 3D printing, although he sees it as complementary, not replacement, technology.

Hansen takes a slightly different view.

“I believe 3D printing will be the next thing to change our industry. When they can mass 3D print moulded parts, that will change the landscape immensely,” he said.

Other trends

Other trends likely to continue into the future include lightweighting, centred in large part on meeting corporate average fuel economy (CAFE) standards mandating fuel efficiency in cars.

In domestic political news, last fall Ottawa announced various initiatives to help kick-start Canadian businesses. Among other measures, the government proposed a move to allow companies to write off a bigger share of the cost of new equipment in the year it was purchased.

“That will go down for me as the best decision this administration ever made. For us, reinvestment is a way of life. We have to do it to survive,” said Azzopardi.

“Tax incentives are always welcome, especially when it comes to machines that are in the million-dollar range,” added Hansen.

Export Development Canada (EDC), a government-run credit agency for exporters, also should be used by manufacturing shops.

“EDC receivables insurance is a service we avail ourselves of for virtually 99 per cent of what we export. It’s almost a staple for any mould shop, especially if you’re in the automotive industry and you’re taking extended payment terms,” said Galbraith.

Such assistance also provides much-needed stability, he added. Cavalier’s biggest short-term challenge is uncertainty in the market, which he said is caused by the current U.S. administration.

Until recently the U.S. also charged a 25 per cent tariff on injection moulds that were imported from China. This levy had a big effect on Canadian companies with operations in that country, said Galbraith.

“If we used some of our sources in China, there was a 25 per cent tariff if we moved that product into the States. It has definitely impacted the way we did business,” added Palmer.

The U.S. government suspended this tariff in late December. While welcome news, this seesaw approach to economic policy has added unwanted turmoil to mould markets.

“They rescinded the 25 per cent tariffs on Chinese moulds in December, but uncertainty is a killer for us. We can play by anybody’s rules, but we need to make sure there’s some stability in the rules. That’s all we ask,” said Galbraith.

Contributing writer Nate Hendley can be reached at nhendley@sympatico.ca.

Aalbers Tool & Mold, www.aalberstool.com

Canadian Association of Mold Makers, www.canadianassociationofmoldmakers.com

Cavalier Tool & Manufacturing, www.cavaliertool.com

Laval, www.lavaltool.net

Plasman Group, www.theplasmangroup.com

About the Author

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Industry Events

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI

17th annual Joint Open House

- May 8 - 9, 2024

- Oakville and Mississauga, ON Canada

MME Saskatoon

- May 28, 2024

- Saskatoon, SK Canada

CME's Health & Safety Symposium for Manufacturers

- May 29, 2024

- Mississauga, ON Canada