- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Tool, die and moldmakers: Sector report

Ask about the future and industry experts offer unbounded optimism.

- By Nate Hendley

- March 9, 2015

- Article

- Metalworking

If you want an example of the optimism that permeates the tool, die and mold-making sector, a good place to start would be Aalbers Tool & Mold, in Oldcastle, Ontario. Founded in 1982, Aalbers is based in Southern Ontario, minutes from Windsor, Canada’s automotive manufacturing epicenter and a region devastated by the recession of 2008 – 2009. Tool, die and mold shops that survived that period are now thriving, unfazed by a sinking dollar, collapsing oil prices, dependence on the auto industry and off-shoring.

Aalbers, in fact, has been on an equipment buying streak—testament to the company’s confidence in improved economic conditions.

“We are an injection mold builder. We mainly build the larger range of tools, from 750 tons and up. We service tools as well. In the past two years, we’ve spent $5 million on equipment,” says Aalbers president, Toni Hansen.

Recent equipment acquisitions at Aalbers include two Amera-Seiki A800 palletized high speed machining centers, two Eagle EDM machining centers and one large Promac vertical machine centre for large tooling.

The company, which operates from a 100,000 square foot facility, also owns machine tools from Makino, Okuma and Takumi.

“We’re looking to spend approximately $3 million this year. We are looking at a few types of machinery…including a large, five-axis [machining centre], a horizontal pallet machine for small mold component manufacturing, and possibly, a larger EDM [electrical discharge machining] machine as well,” Hansen continues.

Aalbers boasts over 100 employees and its own 3D design department. The company recently expanded operations into new territories, opening a repair and service facility in Queretaro, Mexico.

Other Canadian tool, die and mold firms also report healthy bottom-lines.

In fact, Canadian companies dominated a list of leading North American tool and mold manufacturers published last October in a U.S.-based plastics industry trade magazine. This annual list ranks companies based on their sales figures. The latest results released to the public were highly gratifying for Canadian patriots with the top five firms of 2013 all based in Canada. From first to fifth place, these companies were, respectively, Husky Injection Molding Systems (a supplier of injection molding equipment with an estimated US$125 million in total sales in 2013), Concours Mold (US$85 million in sales), Integrity Tool & Mold (US$84.4 million), Omega Tool Corp (an estimated US$65 million in sales) and Active Burgess Mould & Design (US$63 million).

Aalbers for its part was number 24 on the list with US$24.5 million in sales for 2013.

To compile the list the magazine converted Canadian sales figures into U.S. dollars, based on a near-par 2013 exchange rate in which a Loonie was pegged at 97 cents to a U.S. greenback.

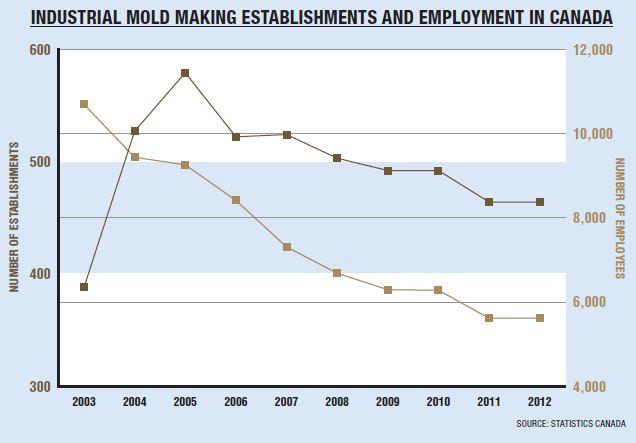

Slightly dated statistics from Industry Canada indicate there were an estimated 464 Canadian establishments with 5,616 employees that made industrial molds in 2012 (the most recent year for which figures are available). This was down significantly from the pre-recession era. In 2005, for example, Industry Canada counted 579 firms making industrial molds.

Industrial mold makers shipped an estimated $959 million of their products in 2012 (down from 2004 when $1.51 billion in shipments were recorded). The United States took in roughly three-quarters of Canadian industrial mold exports in 2012.

One recent bit of bad fiscal news—the sinking Canadian dollar—is widely hailed as a positive development by tool, die and mold makers.

“The Canadian dollar being lower to the U.S. dollar helps us with our American customers,” says Hansen.

“Certainly, from a mold makers perspective, if your customer is American, that gives you a little bit of a competitive advantage,” says David Palmer, sales manager at Build-A-Mold in Windsor, and chairman of CAMM (the Canadian Association of Moldmakers), a trade group also based in Windsor.

Build-A-Mold is listed at number 19 on the Plastics News list, with an estimated US$35 million in sales in 2013.

A Loonie hovering around 80 cents “is sort of ideal, it’s not too low,” echoes Mike Hicks, vice-president of DMS in Oldcastle, Ontario and long-time CAMM board member.

Hicks hopes the Canadian dollar stays near 80 cents. “Our shops don’t like to see a fluctuating situation”—that is, a dollar rapidly gaining or losing in value against the U.S. dollar within a short period of time.

DMS supplies components to molders, die-casters and mold shops across North America. Because the company ships far and wide, Hicks hails the recent slide in oil prices.

“With Canada being such a big exporter, many of our mold shops rely on transportation to deliver their molds to the United States and/or Mexico…obviously, lower fuel prices are good for our industry…even little things like floor utilities, heating buildings, that type of thing…there’s a savings,” says Hicks.

Low oil prices are also a boon for companies that make plastic car body parts—plastic being a key element in “light-weighting” vehicles for fuel efficiency. Spurred by government fuel economy regulations and consumer demand, light-weighting is an ongoing initiative in automotive circles.

Light-weighting, and growing use of plastic body parts in vehicle manufacture, is a reminder of the close ties between the tool, die and mold sector and the automotive industry. Indeed, on January 6, 2015, CAMM announced it had entered into a “collaborative working relationship” with the Automotive Parts Manufacturers’ Association (APMA).

The two groups will work together on advocacy, trade missions and special events.

“We seem to be very aligned with the successes of the automotive industry ... since 2008/09, there’s been a good resurgence” in auto making, says Palmer.

The automotive industry is “probably 85 to 90 per cent of what [moldmakers in Canada] do,” he continues.

Hansen, for her part, estimates that 90 per cent of Aalbers’ work is auto-related, primarily with Ford, GM, Chrysler and Honda.

A total of 2.379 million vehicles were made in Canada in 2013, a drop of 3.4 per cent from the year before. By contrast, 11.066 million vehicles were made in the United States in 2013, an increase of 7.1 per cent.

These figures come from the Paris-based International Organization of Motor Vehicle Manufacturers (known as the “Organisation Internationale des Constructeurs d’Automobiles” or OICA in French).

OICA figures for the first half of 2014 offer much of the same. A total of 1.186 million vehicles were made in Canada during the first six months of 2014, a 1.8 percent dip, while 5.943 million vehicles were made in the same period in the United States, a 4.7 per cent increase.

Pundits say the slight dip in Canadian production is nothing to be feared; production is relatively stable, which is a vast improvement over the recessionary years when vehicle manufacturing bounced wildly up and down (Canadian production in 2008 slid 19.3 percent from the previous year, sank a further 28.4 per cent in 2009 then shot up by 38.8 per cent in 2010, according to the OICA).

Secondly, domestic moldmakers tend to ship their products across the continent. As long as the American auto industry is healthy, all is good in the moldmaking sector.

PPAP terms remain the norm for contracts with the Big Three automakers, GM, Ford and Chrysler. Under PPAP (which stands for ‘Production Part Approval Process’), all components from suppliers must meet exacting standards before being approved for use in an OEM’s production line. Suppliers don’t get paid until all their parts are approved, which can take months, even years.

Some shops have been able to work around PPAP terms, however.

“There’s examples where tier one and tier two suppliers and even OEMs say, ‘I’ll pay you progressively so that you’re not out of pocket for a year-and-a-half,’” says Palmer.

In such a scenario, a shop is paid a percentage of their fee at regular intervals starting shortly after delivery so they don’t have to “wait a year, a year-and-a-half before they get their money” from an OEM, he explains.

Traditional offshoring, in which manufacturers move operations to low-cost countries such as China, doesn’t appear to be the burning issue it used to be.

“They’re still building tools in China, but with the investment in new technology, high speed, lights out operations [in Canada], we’re bringing our costs down. China is essentially raising their prices a little bit. China is not the big pull it once was,” says Palmer.

And of course, some companies were displeased by the poor-quality of tools and molds produced in low-cost locales and have brought operations home.

That said, there’s currently a trend among tool, die and mold shops to open satellite operation in Mexico.

“A lot of the Canadian tool shops are being somewhat pressured by the OEMs and tier ones to have capabilities in Mexico,” says Palmer.

Pundits insist that Mexican satellite operations are not an economic threat to tool, die and mold manufacturing in Canada.

“The satellite operations primarily do service, repair, maintenance work—secondary work…most of the new [mold] builds are done in Canada, because that’s where the most sophisticated equipment is…the bulk of the skilled [tool, die and mold] workforce is in Canada,” says Hicks.

“If you have a tool built from the lowest bidder, in any country, you take the risk of a failure occurring in production. We have been building high quality injection tooling for 33 years and will continue to be relied on for this service,” adds Hansen.

Of greater concern is the looming shortage of skilled workers due to a rapidly aging workforce and a lack of replacements.

“I think the average age of a mold maker in Canada is like 50 years-old. We need to rejuvenate our workforce. We’ve worked closely with St. Clair College in Windsor and work very closely with apprenticeship programs” to encourage young people to consider a career in the tool, die and mold sector, says Palmer.

Interestingly enough, Hicks suggests the advent of satellite operations in Mexico might actually “attract young talent to the industry.”

These satellite operations are hungry for workers and offer “a lot of career opportunities” for young Canadians entering the job market, he points out. Young workers might toil a few years in Mexico before moving back to Canada and taking jobs at home.

The notion of building a younger tool, die and mold workforce by opening Mexican operations is an intriguing suggestion. This proposal exemplifies the positive outlook the tool, die and mold sector has embraced.

Ask about the future and industry experts offer unbounded optimism.

“Unless there’s something really bad, all indicators are very, very strong,” says Hicks.

“Without any global economic crisis, I think we’re going to be pretty healthy. We’ve come through 2008, so people are not going to forget that. They’re not going to overextend themselves,” echoes Palmer.

About the Author

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free Subscription- Industry Events

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI

17th annual Joint Open House

- May 8 - 9, 2024

- Oakville and Mississauga, ON Canada

MME Saskatoon

- May 28, 2024

- Saskatoon, SK Canada

CME's Health & Safety Symposium for Manufacturers

- May 29, 2024

- Mississauga, ON Canada