- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

By the Numbers: One measure of economic recovery

For investment flowing into Canada, a full two-thirds of the growth in foreign direct investment in 2013 was directed it to the manufacturing and mining sectors.

- By Canadian Metalworking

- August 6, 2014

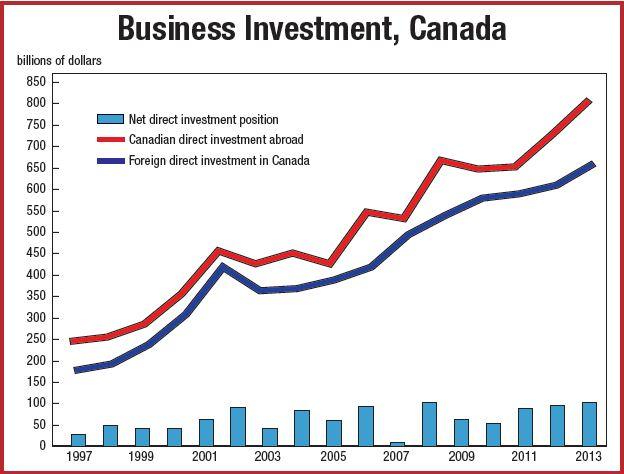

Direct investment, both investment in Canada, and Canadian direct investment abroad, is a good indicator of business sentiment in two ways: Canadian firms’ optimism about global markets, and the world’s confidence in the Canadian economy.

Statistics Canada tracks this essential metric, which showed that Canadian direct investment abroad grew by 9.4% in 2013, reflecting both increased investment activity as well as the upward revaluation effects of a weaker Canadian dollar. The level of foreign direct investment in Canada (+9.5%) advanced at a similar pace during the year, led by investment from the United States. In dollar terms, Canadian direct investment abroad increased by $66.7 billion to $779.3 billion in 2013. Foreign direct investment in Canada increased by $59.5 billion to $686.3 billion over the same period.

It’s no surprise that the majority of the increase in Canadian direct investment abroad occurred in the US and the United Kingdom. The investment position in the United States increased by $28.6 billion to $317.7 billion in 2013. Canadian firms added $9.5 billion to their direct investment position in the United Kingdom for a total position of $86.0 billion.

A weakening Canadian dollar relative to other currencies is also had an upward effect on asset valuations. Manufacturing was a major target of Canadian foreign investment in 2013 increasing by 17.6% to $72.8 billion. Overall, the share of Canadian investment abroad going into the manufacturing sector has fallen from a peak of 31.9% in 2000 to 9.3% in 2013.

Where do the majority of Canadian investment dollars go? The finance and insurance sector, with 40.2% of overall Canadian direct investment abroad. For investment flowing into Canada, a full two-thirds of the growth in foreign direct investment in 2013 was directed it to the manufacturing and mining sectors. Manufacturing was number one, with a 30.5% share of overall investment, followed by mining and the petroleum industry with 20.3%. The “financialization” of capital continues, but with the global recovery driving resource demand, Canada is well placed for a manufacturing resurgence.

subscribe now

Keep up to date with the latest news, events, and technology for all things metal from our pair of monthly magazines written specifically for Canadian manufacturers!

Start Your Free SubscriptionAbout the Author

- Trending Articles

Automating additive manufacturing

Sustainability Analyzer Tool helps users measure and reduce carbon footprint

CTMA launches another round of Career-Ready program

Sandvik Coromant hosts workforce development event empowering young women in manufacturing

GF Machining Solutions names managing director and head of market region North and Central Americas

- Industry Events

MME Winnipeg

- April 30, 2024

- Winnipeg, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Windsor Seminar

- April 30, 2024

- Windsor, ON Canada

CTMA Economic Uncertainty: Helping You Navigate Kitchener Seminar

- May 2, 2024

- Kitchener, ON Canada

Automate 2024

- May 6 - 9, 2024

- Chicago, IL

ANCA Open House

- May 7 - 8, 2024

- Wixom, MI